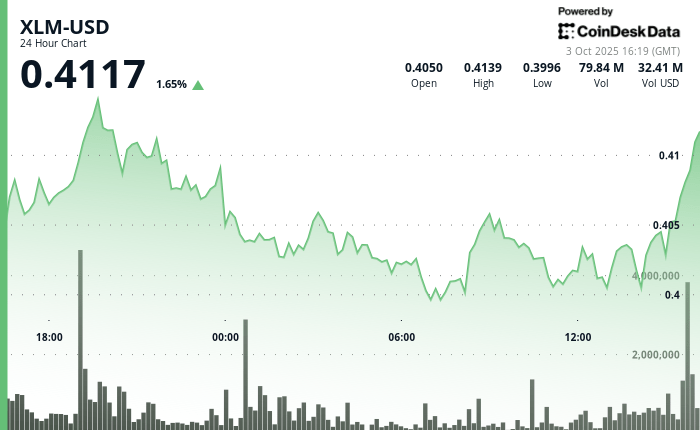

Stellar’s XLM token strongly reversed on October 3 after briefly testing new heights. The token went to $ 0.4041 in exchange for the afternoon, but a large sale after 2:00 p.m. UTC brought it back to $ 0.4015, erasing the previous gains.

The volumes increased during the sale, with more than 1.4 million tokens exchanged in a single minute, reporting an institutional sale to resistance and increasing the risk of new decrease.

This decision comes as Bitcoin.com Wallet Integrated Stellar and its DEFI protocols, widening the scope of XLM payments. Seasonal trends can support, in October historically a solid month for the crypto, although the short -term pressure remains.

Summary of technical indicators

- The volume analysis revealed an increased activity during the initial advance with an exceptionally high sales volume exceeding 1.4 million during the period 14: 00-14: 01.

- The resistance was formed around $ 0.41 to $ 0.41 per area where the price has met on several occasions.

- The support levels identified nearly $ 0.40 to $ 0.40 when the purchase of interest materialized several times.

- The consolidation formation developed between $ 0.40 and $ 0.40, indicating potential accumulation.

- Inversion model lowering by institutional distribution to session peaks.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.