The trading trade, also known as healthy money or hard asset trade, is indeed alive. Bitcoin (BTC), at more than $ 120,000, is just a stone’s throw from its $ 124,000 summit. Meanwhile, Gold almost won 50% for the start of the year, establishing new records almost every day and now negotiating just below $ 3,900.

The funds negotiated on the stock market highlight the enthusiasm of this trade. The BlackRock’s Ishares Trust (IBIT) and the SPDR Gold ETF (GLD) ranked among the most negotiated 10 ETFs on Thursday, a rare event according to the Senior ETF of Bloomberg, Eric Balchunas.

The GLD experienced $ 4.88 billion in volume, making it the fourth ETF the most negotiated, while Ibit arrived seventh with $ 3.21 billion. The most negotiated ETF was the S&P 500 ETF SPDR (SPY) with more than $ 26 billion in volume.

“Everyone wants to enter the debtor trade, I suppose,” said Balchunas.

The actor and the defender of money Sound, Dominic Frisby, told Coindesk exclusively that Bitcoin and Gold share a single property: they cannot be printed by governments.

Frisby: “Bitcoin is in a few percent of the summits of all time. Gold is all time.

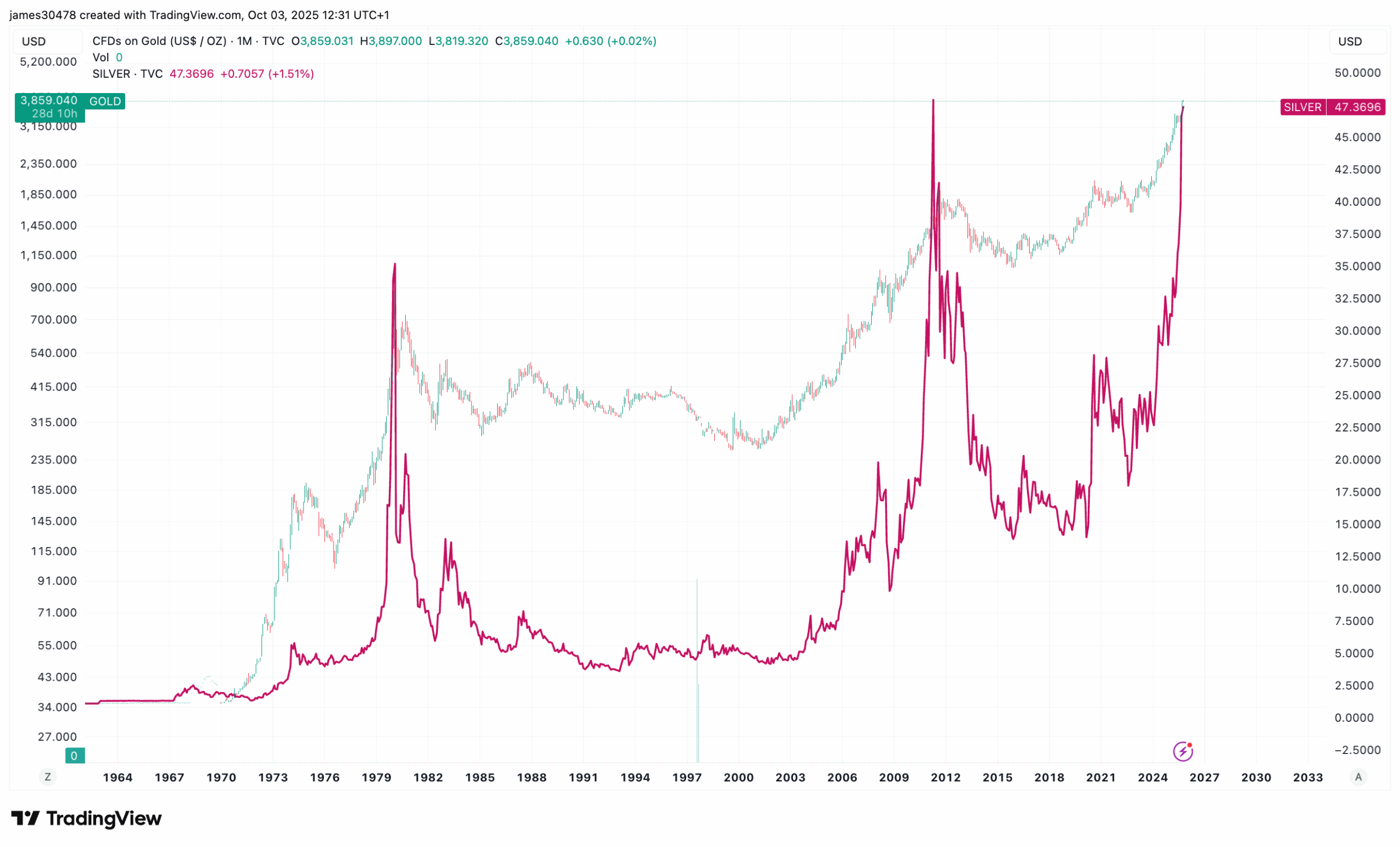

Silver jumped alongside Gold, currently negotiating a little less than $ 48, his third highest level behind Peaks in 2011 and 1980. The Entraide, during these two years, the best of Silver coincided with Gold’s. If history rhymes, it could suggest that when money ends its parabolic race, gold can also exceed. This scenario could well create the path to potential even more upon Bitcoin.