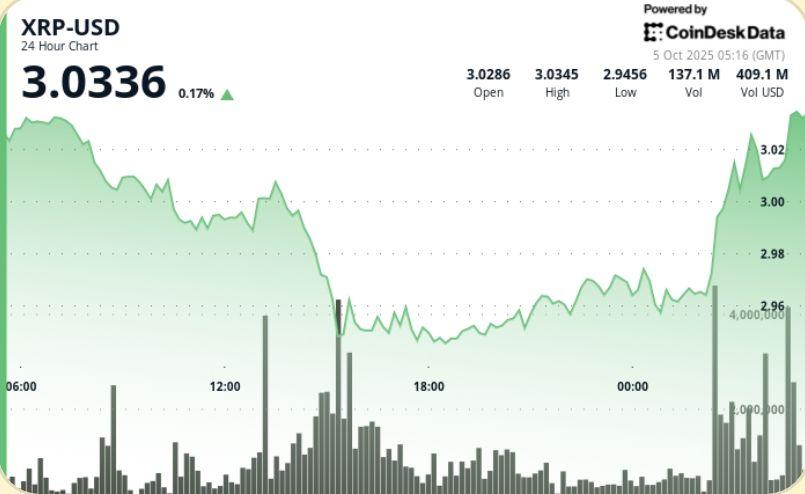

XRP pushed the psychological level of $ 3.00 in the early Sunday trade in Asia, reversing the ventilation on Saturday which saw the token hit the bottom by $ 2.95. The rebound followed a heavy volume rinsing that has cleared the long, with good deals hunters and whales that work aggressively. Traders now consider the range of $ 3.10 to $ 3.30 as a key battlefield, with small groups targeting $ 4.00 to $ 4.20.

New context

• ETF XRP deposits – Seven live – transport decision windows in October that merchants supervise as “binary” events for the action of prices in the fourth quarter.

• The Japanese partner of Ripple SBI deepened its loan program linked to XRP last week, fueling institutional integration stories in Asia.

• The wider crypto markets remain volatile after $ 1.7 billion in derived liquidations, although the entries in the XRP wallets exceeded 160 million tokens last week.

Summary of price action

• Rejection at $ 3.03 on October 4 confirmed short -term resistance.

• Ventilation at $ 2.95 between 13: 00 and 15: 00 reached a volume of 122 m – 3X average.

• Closing stabilization at $ 2.96 at $ 2.97 prepared the ground for the resumption of Asia.

• Sunday morning, XRP has been decisively pushed through $ 3.00, reversing the level of support.

• Momentum traders now report $ 3.30 as next test, with $ 4.00 + as a projection in small groups.

Technical analysis

• Support: Fresh base at $ 2.95 at $ 3.00 defended by high volume accumulation.

• Resistance: $ 3.03 CAP in the short term, with rupture zone identified at $ 3.30.

• Trend: head of head and opposite in reverse upper time intact, looking at $ 4.20 at $ 4.80 if $ 3.30 departs.

• Volume: rinse volumes 122 m of strong rotation signal, while Asian hours show an accumulation of renewed whales.

• Momentum: RSI MID-50S suggests a thief neutral bias; MacD trend towards the bullish crossover.

What traders look at

• Can XRP Sustain close above $ 3.00 and build a base for a race at $ 3.30 at $ 3.50?

• ETF decision window of October 18 of the SEC in the approvals of ETF Altcoin of October 18.

• Whale portfolio flows and reserve changes to exchange are positioning drivers.

• Tell Macro: The dominant liquidity flows of Fed and Asian liquidity shaping the appetite for risks.