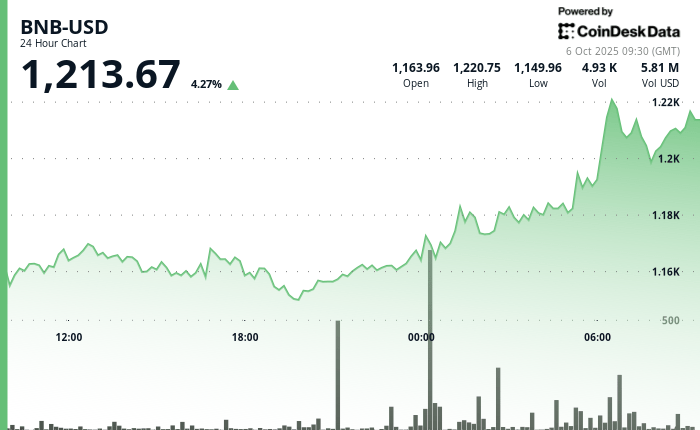

The BNB, the token which feeds the BNB channel and is used for discounts on the costs on Binance, joined more than 4% in the last period 24 hours a day, exceeding $ 1,200 and reaching an intra -day summit of $ 1,223.

This decision was fed by net volume peaks, a renewal of institutional interests and an increase in network activity. The rally aligned with the BNB chain recovering its place as a blockchain most used by active addresses.

In September, he recorded 52.5 million active addresses, exceeding Solana for the first time since August, according to Tokenterminal data. Behind the activity, there was a strong increase in exchanges and decentralized loans on the Aster protocol, which saw its total value locked 570% to 2.34 billion dollars, by Defillama.

Signs of momentum of retail has also appeared. A high -level trader same has transformed a bet of $ 3,000 into almost $ 2 million after a Binance founder position, Changpeng Zhao, triggered speculative interests.

The arrows are accompanied by a wider institutional commitment. The manufacturer of electric vehicles Jiuzi Holdings and Alem Crypto Fund in Kazakhstan both added BNB to their treasury bills.

It should also be noted that BNB has benefited, with the wider cryptography market, expectations that the federal reserve will reduce interest rates of 25 base later this month, and a recent upgrade where the BNB chain reduced its minimum gas costs to 0.05 Gwei.

Preview of technical analysis

BNB exchanged in a wide range on the session, moving between a minimum of $ 1,148.12 and a summit of $ 1,223.08, according to the Technical Analysis Data model of Coindesk Research.

The price closed at $ 1,16, marking a gain of 2.27% compared to the 24 -hour window. The most notable price action came while the BNB has brought $ 1,200 on a peak in negotiation volume, a burst of activity reaching almost five times the daily average. This increase in volume coincided with the intrajat high, which now marks a key resistance area around $ 1,223.

The support clearly emerged from $ 1,148 to $ 1,158, where the purchase of pressure has appeared constantly throughout the session. Each dive into this area has attracted a new request, suggesting that institutional orders can be superimposed at these levels.

The wider trend remains upwards, the action of prices reflecting a regular accumulation and a desire of buyers to absorb volatility.

However, a net reversal at the end of the session reported caution. After testing the $ 1,215 zone, the BNB returned quickly to $ 1, 2016, reducing previous gains.

A high volume during this decline suggests taking profits rather than the sale of panic, probably greater holders capitalizing on the resistance near recent peaks. Despite the retrace, BNB maintained most of its earnings and maintained above the $ 1,200 mark, keeping the current rally intact.

Non-liability clause: Certain parts of this article have been generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.