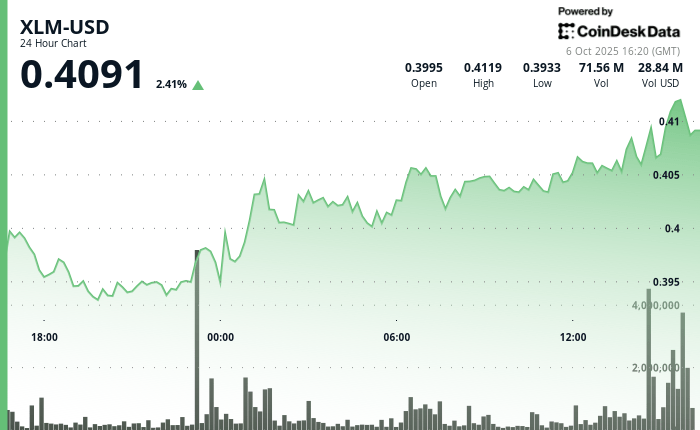

The Lumens Stellar (XLM) climbed 3% on a 23-hour section ending on October 6, going from $ 0.40 to $ 0.41 while institutional trade increased above 71 million tokens.

This decision followed a technical rebound of $ 0.39, traders stimulating demand during peak negotiation hours and supporting a regular rally thanks to key resistance levels.

XLM’s ability to maintain above the bar of $ 0.41 – a level that previously capped price gains – reflects continuous institutional accumulation and confidence in the long -term role of the token in the financial infrastructure based on blockchain.

Analysts consider the coherent purchase pressure of companies’ accounts as proof of growing recognition of the usefulness of Stellar companies.

Market strategists see an upward potential, identifying XLM as one of the most undervalued payment tokens below $ 1.00.

They predict that the token could tackle the level of $ 1.00 in the next institutional adoption cycle as the blockchain payment networks are gaining ground in the global business finance landscape.

Technical measures indicate an institutional accumulation

- Solid institutional support established at $ 0.39 with a volume confirmation of companies of 62.57 million tokens during the negotiation session of October 5.

- Technical resistance at $ 0.41 has shown several phases of institutional tests before a break in success in business purchases.

- The ascending price trend of the base of $ 0.39 provided coherent institutional support throughout the accumulation phase.

- The business negotiation activity remained high during key prices movements, in particular at 13:38, a volume of chips of 2.86 million confirming the institutional breakthrough greater than $ 0.41.

- Higher sequential price levels have demonstrated a sustained accumulation of companies during final negotiation hours.

- Daily negotiation volumes exceeded 71 million tokens during institutional negotiation hours, significantly higher than the average of companies of 25.43 million 24 hours.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.