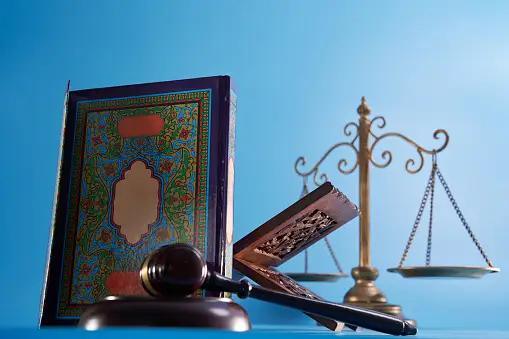

Made, a digital asset investment platform, has received a provisional banking license in Malaysia, paving the way to what it calls the first Islamic digital bank fed by stables in the world.

The move Place is in a regulated sandbox for the Islamic fintech, allowing the company to extend its platform of existing digital assets in full service, the company announced on Tuesday in a press release.

With the new license, Fasset plans to offer savings, financing and investment services in accordance with Sharia law which use stablescoins and token assets. Customers will be able to have deposits, invest in American actions, gold and crypto, and spend via a planned crypto-line card.

CEO Mohammad Raafi Hossaine said that the new license is combining “the credibility of a world banking institution with the innovation of a fintech insurgent”. Fasset also plans to deploy “OWN”, an Ethereum Layer 2 network built on Arbitrum, to settle regulated active assets in the real chain.

The company said that its stablecoin infrastructure allows users to avoid products with interest while preserving the value of their assets against inflation or currency fluctuations. Shariah prohibits all forms of interest (called riba).

Makes to fill a persistent gap in financial inclusion in the global Islamic finance industry of 5 billions of dollars. Access to Halal financial products supported by assets remains limited in many regions of Muslim majority, in particular in Asia and Africa.

In March of last year, Fasset won a license to operate in Dubai as a virtual asset service provider (VASP), and the company based in Dubai and Jakarta said that its platform already dealt with more than $ 6 billion in volume of transactions annualized in 125 countries.