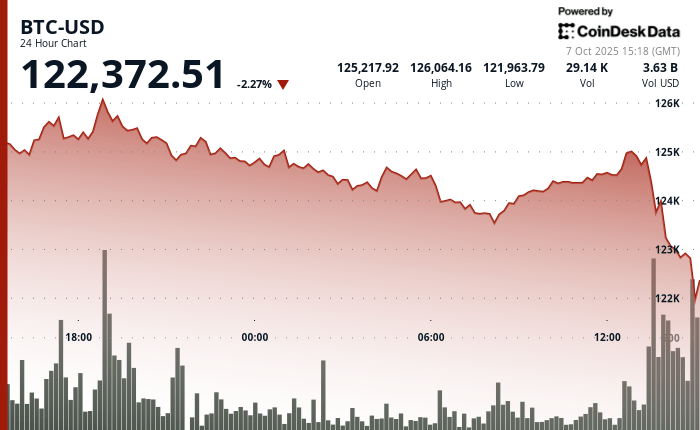

The crypto rally took a break Tuesday with Bitcoin Quickly withdrawing from records greater than $ 126,000 while analysts highlighted signs of overheating the crypto rally, at least in the short term.

The BTC plunged below $ 122,000, erasing the gains from the last three days and running down 2.4 % in 24 hours. The sale has spread to the cryptography market, with ,, ,, And down 5 to 7 % over the period.

If the evolution of bitcoin prices seems familiar, it is because it is. Despite a gain of 31 % since the start of the year, Bitcoin gave bulls very little chance of enjoying their victories. Each record summit was apparently followed by a quick and viscous sale. Consider the first race at $ 109,000 just before Trump’s inauguration in January. This amount has reversed $ 100,000 in hours and $ 75,000 in three months.

The first movement in July above $ 123,000 resulted in a drop of approximately 10 % in the following days. And a similar increase above $ 120,000 in mid-August suggested a fall of approximately 15 % in the following days.

The decreases this time occurred after Bitcoin has climbed 16% almost vertically compared to the lowest at the end of September, below $ 109,000.

Jean-David Péquignot, CCO of the Deribit Options Market, planned in a Monday report that BTC could return to the area from $ 118,000 to $ 120,000, shaking the traders that missed the lowest and joined the late rally. If this decline occurs, he said, this would offer an opportunity to purchase, because the technical parameters and the macro environment align so that BTC exceeds $ 130,000 in the last quarter of the year.

The derivative products market and ETF flows have also been overheated, said Vetle Lunde, research manager at K33. He noted that last week marked the highest BTC accumulation of the year, with a total of 63,083 BTC (worth approximately $ 0.77 billion) added to the American ETFs, CMEs and perpetual term contracts, exceeding the peak of May. This increase was motivated by a generalized long positioning betting on higher prices without a clear macroeconomic catalyst, opening the way to a withdrawal.

“Historically, similar exposure thrusts have often coincided with local summits, and the current configuration suggests a temporarily overheated market with a high risk of short -term consolidation,” said Lunde.

MIRAN DE LA FED estimates that the neutral rate should be 0.5%

The governor of the federal reserve, Stephen Miran – recently appointed by Trump – said Tuesday that his point of view on the neutral interest rate had moved “from one end to the other of the range”, during a discussion within the Managed Funds Association Policy Outlook 2025. He now estimates that the neutral rate should be 0.5 %. Miran underlined the stricter restrictions on immigration and the evolution of expectations concerning the federal deficit as the main factors behind its re -evaluation.

Miran’s comments suggest that long -term forces that shape the American economy are changing. A smaller labor pool could limit growth, while increasing budgetary pressures could make Fed balance exercise more complex between inflation and employment. His remarks come as part of political decision -makers debate the room for maneuver available to the Central Bank to reduce rates without rekindling prices.

Fed officials meet at the end of the month to decide a possible new drop in rates, without however critical data to be provided by the government when the closure continues.

Miran also noted that economic growth in the first half has been lower than expected, weighed down by uncertainty concerning commercial and fiscal policy. But Miran adopted a more positive tone for the coming months, saying that a large part of this uncertainty was now dissipated. “With lighter political signals, I expect a more stable growth rate,” he said.

Cryptographic actions suffer

The wide decline in cryptography prices strikes associated shares, driven by a 7 % drop in the strategy (MSTR) and a loss of 4 % of Coinbase (corner). Ether Bitmine Immersion (BMNR) and Sharplink Gaming (SBET) cash companies are decreasing respectively by 3 % and 7 %.

Bitcoin minors are mostly in the red, led by Mara Holdings down 4 % and Riot Platforms (Riot) down 3 %. Cabin 8 (Hut) is 2%lower.