Many can change in a few days. Bitcoin has recently reached new heights of all time in terms of US dollars and Japanese yen, stimulated by the new Japanese Prime Minister, the bias of Takaichi Sanae for the framework of ultra-facilitated Adomic Policy.

However, the same bias of Abenomics now seems to work against the BTC thanks to its impact on the bond market.

One of the main characteristics of ABENOMICS is the implementation of an expansionist budgetary policy, characterized by an increase in public spending to support economic growth. In other words, the supply of obligation could increase, aggravating the tax perspectives already Auver.

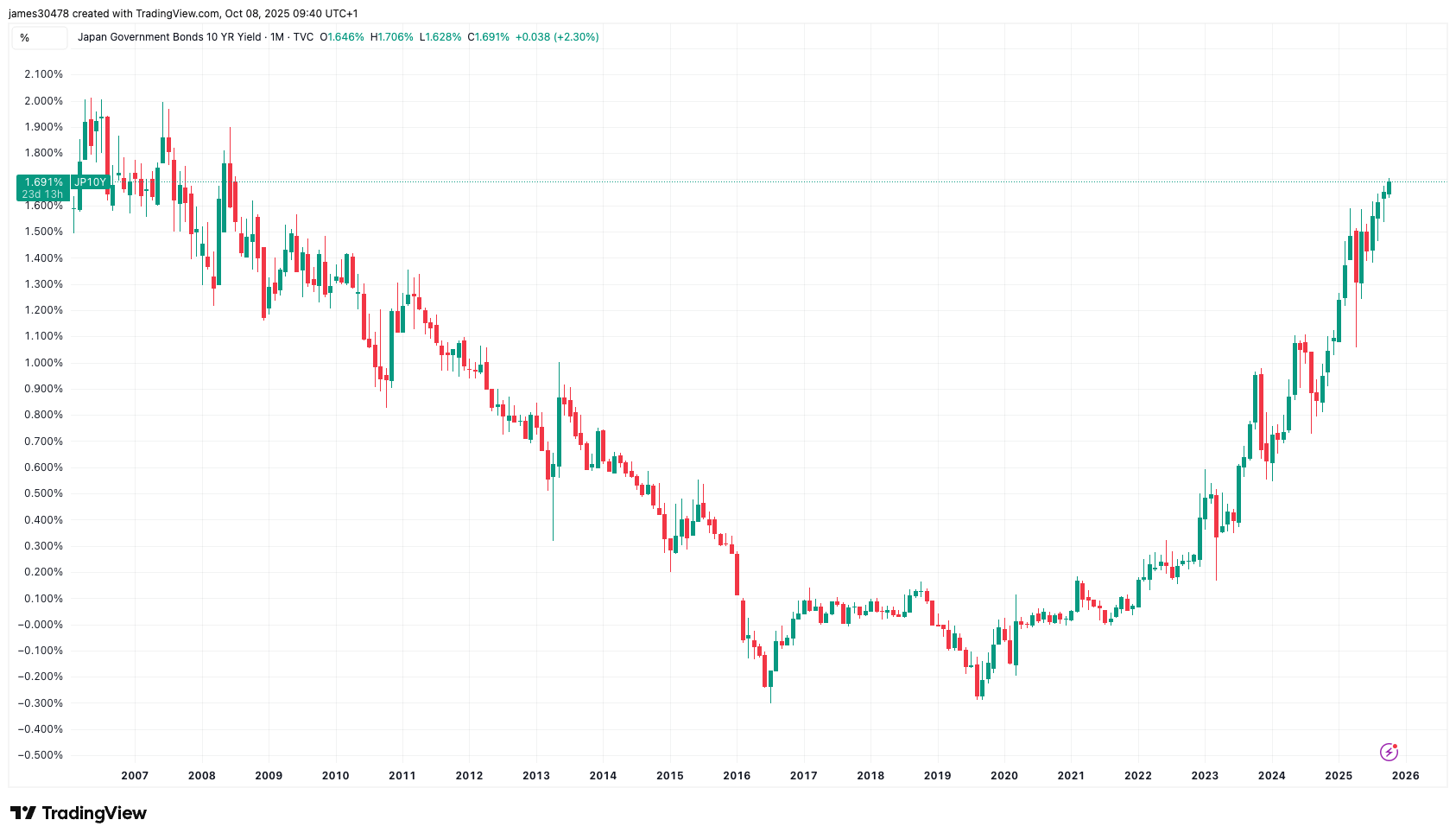

Japanese government’s obligations seem to be prices, pushing higher yields. (The prices of bonds and yields move in the opposite direction). According to TradigeConomics, the yield of JGB at 10 years reached a summit of 1.70% early Wednesday, the highest since July 2008. It increased by 13.31 base points in one week and more than 76 base points in 12 months. The yield in 30 years increased to 3.34% and quickly fell to 3.16%.

The increase in bond yields generally ZAPT the appetite of investors as they increase the cost of the loan, deleting the call of risky assets such as shares and cryptocurrencies. Some analysts consider Bitcoin as a risk asset and a digital gold form, although historically data show that cryptocurrency tends to further follow technological stocks.

The JGB yield increase is even more worrying, given its impact on global obligations. According to Goldman Sachs, the volatility of Japanese bonds could spread in cash tickets, adding to market nervousness.

For all the 10 base points “Idiosyncratic JGB shock (Japanese government’s jump)”, investors can expect approximately two to three points of upward pressure on American, German and British yields, said Goldman Sachs strategists in a recent market note, according to Bloomberg.

Strength in dollars

The dollar index has reached a two -month summit and the move is probably led by depreciation in the Japanese Yen, which has dropped by 3.5% against the USD since Friday.

The decline of the JPY is also linked to Abenomics, which requires low interest rates at home. The probability of an increase in rates of Bank of Japan (BOJ) this month has dropped since Sanae spoke of Abenomics on Saturday.

The dollar index includes six large fiduciary currencies – EUR, JPY, GBP, CAD, SEK and CHF. The euro has the highest followed by the yen.

An increasing DXY often causes financial tightening and trays upwards, gold and other assets denominated in dollars.

While the BTC rally is at a standstill, gold remains fully not affected, pushing through $ 4,000 an ounce while investors continue to request an exposure to the packages.