Dogecoin failed to hold above $0.26, triggering significant institutional profit-taking that pushed the price back towards $0.25.

Despite the short-term pullback, on-chain flows show large holders adding 30 million tokens (around $8 million), suggesting accumulation remains intact even as resistance limits bullish momentum.

News context

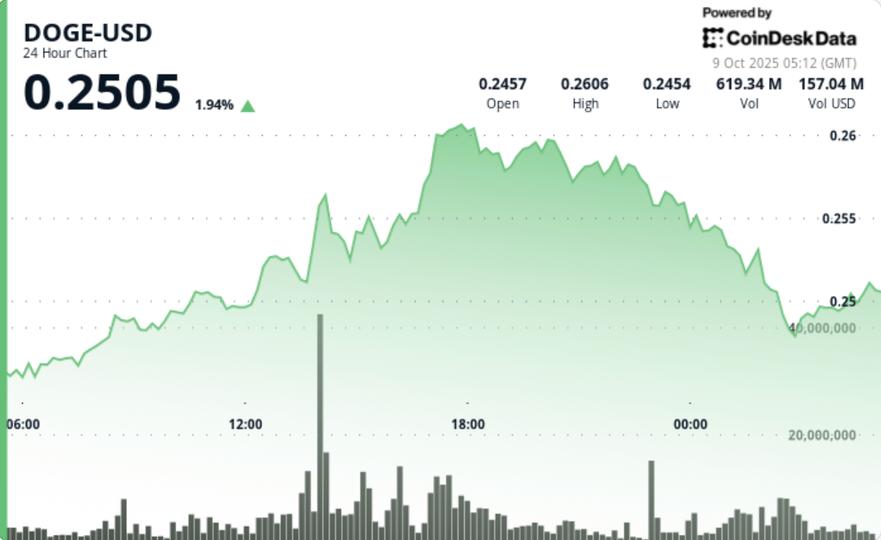

DOGE traded in a 6% range between $0.24 and $0.26 in the 24 hours leading up to October 9. The token rebounded to $0.26 during the afternoon session, but encountered heavy institutional selling pressure. Whale addresses added over 30 million DOGE, strengthening long-term positioning despite short-term weakness. Analysts pointed to parallels with previous historical cycles, where key resistance breakouts unlocked exponential upside, with $0.41 flagged as a critical long-term trigger.

Price Action Summary

- DOGE rose from $0.25 to $0.26 around 5:00 p.m. on a turnover of 750 million, double the daily average.

- Significant profit-taking at $0.26 wiped out the gains, bringing the price back to $0.25 as the session closed.

- Late trading saw a break below $0.25 as liquidation flows hit, with a rise of 14.6 million at 02:01 confirming the distribution.

- DOGE closed at $0.25, down about 2% from intraday highs.

Technical analysis

Resistance is strengthened at $0.26 after repeated rejections on high volume. Support at $0.25 failed late in the session due to liquidation flows, increasing near-term downside risk. Still, the accumulation patterns – with 30 million DOGE added by large wallets – speak to institutional confidence in the larger structure. A sustained recovery of $0.26 would open the way towards $0.27-$0.30, while $0.24 is now the floor to watch in the near term.

What are traders looking at?

- If DOGE can quickly regain $0.25 support after the liquidation.

- If the accumulation of whales continues to offset the distribution in the event of resistance.

- A clear break at $0.26 to reestablish bullish momentum.

- Longer term watch: resistance at $0.41, linked to historical breakout cycles.