XRP has been split in a narrow band from $2.78 to $2.85, masking heavy institutional selling and growing leverage risks. FX reserves hit a nine-month high on 440 million tokens distributed over 30 days, while futures open interest swelled to nearly $9 billion.

Bulls continue to defend the $2.78 floor, but distribution patterns limit upside momentum.

News context

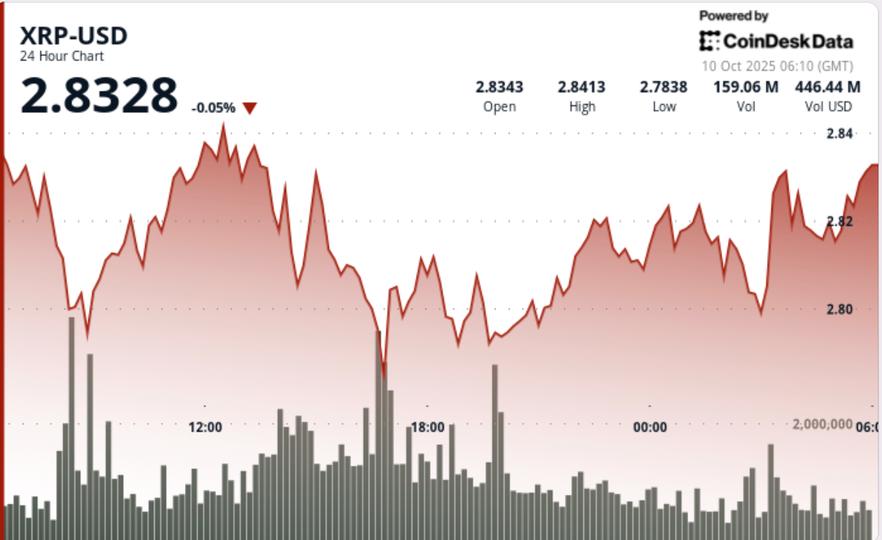

XRP traded lower in the 24 hours leading up to October 10, opening near $2.83 and closing at $2.82. The token briefly rebounded to $2.85 before being rejected, with volumes exceeding 123 million as of 08:00 – double the daily average – confirming institutional activity at key levels. The session unfolded as traders positioned themselves ahead of macroeconomic catalysts, with Fed policy and regulatory clarity continuing to shape sentiment.

Price Action Summary

- XRP was hovering between $2.79 and $2.85, a 2% corridor.

- Resistance remained firm at $2.85, with a rejection at midday.

- Support persisted at $2.78, defended several times on high volume.

- The end of the session saw a drift from $2.83 to $2.82, with 1.6 million draws confirming continued distribution.

- Final bars showed declining volume, hinting at a sell-off near $2.82.

Technical analysis

The $2.85 area has hardened into supply after several rejections, while $2.78 remains the key support pivot. FX flows and large holder distribution reinforce near-term downside risk, particularly as leverage builds with OI futures approaching $9 billion.

Yet repeated defenses of $2.78 signal institutional accumulation at the base. A break above $2.85 could reopen $2.90 to $3.00, while a move above $2.78 risks accelerating towards $2.72.

What are traders looking at?

- If $2.78 continues to serve as a structural floor.

- If the leveraged positioning unravels, it adds volatility to the attempt to retest $3.00.

- Continuous distribution of whales versus signs of trough accumulation.

- The ETF and Fed catalysts are driving the next breakout of the $2.78 to $2.85 range.