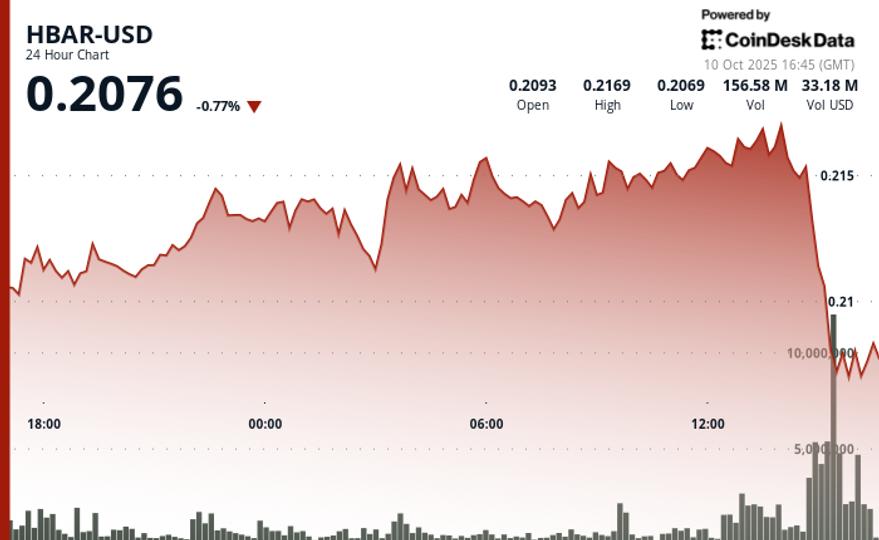

Hedera Hashgraph’s HBAR token saw heavy institutional selling pressure during the 24-hour trading period ending October 10, with prices fluctuating in a volatile 6% range between $0.21 and $0.22. Despite early resilience that saw HBAR climb to intraday highs near $0.22, the digital asset reversed sharply in the final hour of trading as institutional investors initiated sell-offs that erased earlier gains.

Trading data highlighted exceptional activity during the sell-off, with volumes reaching 262.49 million, almost six times higher than the session average of 47.32 million. Analysts identified 3 p.m. on October 10 as the inflection point, where the heaviest selloff took place. The sharp increase in volumes and pricing pressure suggests coordinated selling by institutional players, possibly as part of a broader portfolio rebalancing.

Technically, HBAR broke through several short-term support levels over this past hour, with price action only stabilizing as trading activity ceased in the final minutes. The sharp decline and subsequent lull may reflect temporary liquidity constraints or trading desk closures as institutions decided to limit their exposure ahead of possible regulatory updates.

Technical analysis for corporate investors

- Key resistance levels formed around $0.22 to $0.22, where interest from institutional buyers repeatedly failed to materialize at higher price levels.

- Corporate support emerged around the $0.21 to $0.21 range before being permanently broken during the final hour’s wave of institutional selling.

- The largest institutional liquidation occurred between 3:30 p.m. and 3:35 p.m., where the trading volume of companies reached over 12.80 million and 16.90 million, respectively.

- Price action moved from $0.21 to a session low of $0.21, before corporate buyers attempted a modest recovery to $0.21 at 3:44 p.m.

- Institutional trading activity completely ceased in the last four minutes (3:56 p.m. to 3:59 p.m.), suggesting closures of corporate trading desks or temporary liquidity constraints ahead of regulatory developments.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.