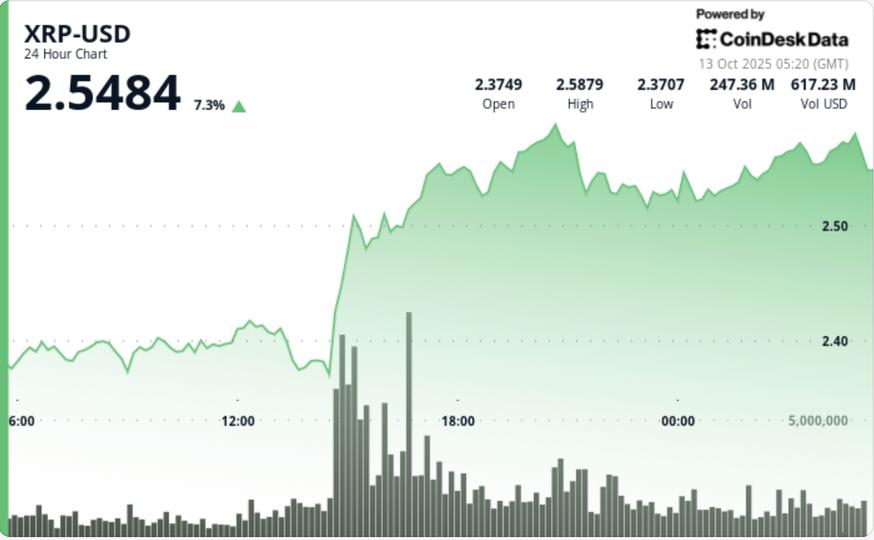

XRP reclaimed $30 billion in market value following last week’s tariff collapse, rising from $2.37 to $2.58 on explosive institutional volume. The bounce was one of the heaviest sessions of the year, confirming aggressive buying on the dips as traders reposition ahead of new macro headlines.

News context

The rally follows a 50% wipeout triggered by President Trump’s declaration of 100% tariffs for China, which wiped out $19 billion in crypto liquidations in minutes. Resumption of buying has since restored confidence, with analysts eyeing a potential record weekly close above $3.12, which would mark XRP’s strongest candle since its inception. The broader markets remain risk-free – Dow –900, Nasdaq –820 – but crypto desks have reported selective institutional entries into XRP.

Price Action Summary

- XRP jumped 8.5% between October 12 at 05:00 and October 13 at 04:00, trading in a range of $0.22 (9%) between $2.37 and $2.59.

- Explosions occurred between 2:00 p.m. and 5:00 p.m., with volumes reaching 276.8 million, more than 2 times the daily average (118 million).

- Support confirmed at $2.37 with high volume reversals; resistance formed near $2.59.

- The late session surge to $2.57 closed at $2.58 on turnover of 2.3 million, validating the continuation.

Technical analysis

The structure now shows a clear ascending channel: base at $2.37, cover at $2.59. A sustained close above $2.59 could open between $2.70 and $2.75, while failure to defend $2.50 risks falling back towards $2.42. Momentum remains bullish with institutional numbers leading each breakout stage. Analysts point to the break above $2.57 as confirmation of a near-term trend reversal; continued volume support keeps the bullish bias intact.

What are traders looking at?

- If $2.57 is the new pivot of support.

- Break above $2.59 to target $2.70-$2.75; stretch goal of $3.00 and above.

- Trade war headlines and Fed speech are boosting risk appetite across several assets.

- ETF speculation and institutional flows support post-crash recovery.