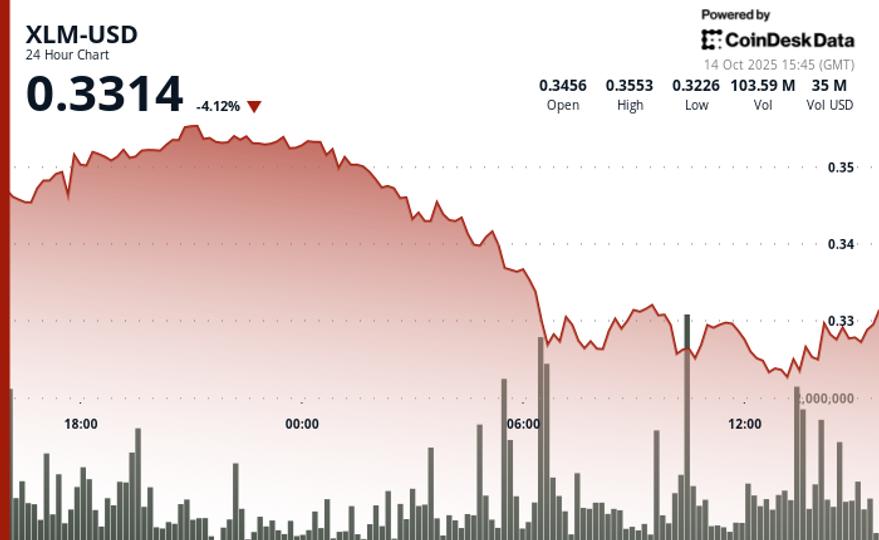

Stellar’s The selling intensified after the token broke key support at $0.34 in early trading on October 14, triggering a strong sell-off and pushing prices to a new local low of $0.32.

The sharp decline showed clear signs of capitulation, with high volume selling hinting at potential oversold conditions. XLM briefly rebounded in the last hour of trading, rising 0.4% from $0.32 to $0.33 as institutional buyers appeared to accumulate at reduced levels.

Trading activity stalled after 2:05 p.m., suggesting market consolidation near the $0.33 resistance zone. The volatility underscores broader uncertainty in the crypto market, with Bitcoin dominance stable at nearly 58%. Despite the turmoil, some analysts remain optimistic in the long term, forecasting a potential rebound towards $1.44 by the end of 2025 based on Elliott wave patterns.

Technical Signals Flash Market Stress

- XLM breaks critical support at $0.34 during the October 14, 04:00 AM session with volume of 48.03 million surpassing the 24-hour average.

- The capitulation sale emerges at a low of $0.32 as volume reaches 63.10 million tokens during the October 14, 1:00 p.m. session.

- Exceptional volatility shows a 2% intraday range with sharp reversal patterns signaling potential oversold conditions.

- Institutional accumulation signals are flashing during the 1:46 p.m. to 1:47 p.m. sessions with an extraordinary volume of 2.67 to 3.68 million tokens.

- Trading activity ceases completely from 2:05 p.m. with zero volume indicating a phase of market consolidation.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.