Digital asset selloff drives DOGE down 5%; offices see base forming as liquidation pressure shows first signs of exhaustion.

News context

- DOGE followed the broader market sell-off triggered by new tariff rhetoric between the United States and China, sliding 5% from a high of $0.21 to settle at $0.20. President Trump’s proposed 100% tariff plan wiped out about $19 billion in crypto market value, triggering forced liquidations among the majors.

- Despite the selloff, institutional desks are reporting accumulation interest near $0.20 as derivatives open interest resets to mid-September levels.

- House of Doge’s $50 million debut on Nasdaq via its Brag House Holdings merger continues to underpin the long-term institutional narrative, even as near-term flows remain risk-free.

Price Action Summary

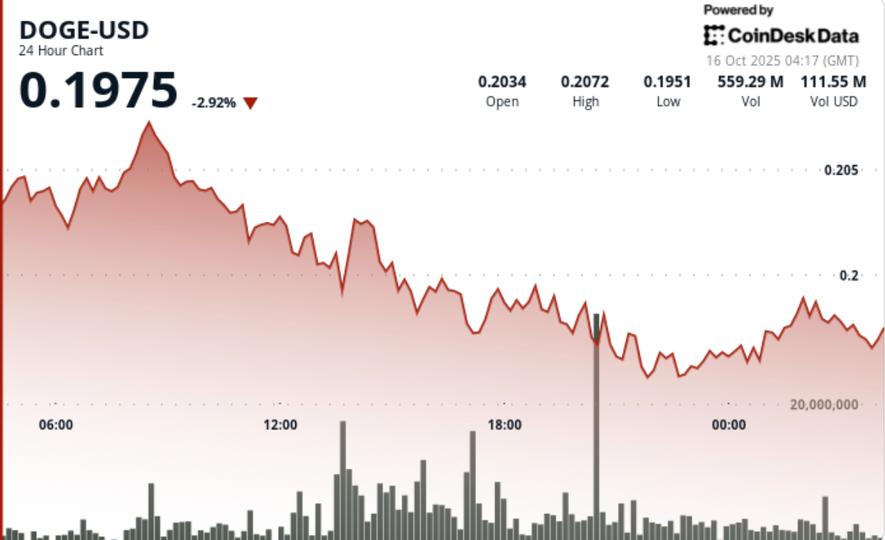

- DOGE traded in a range of $0.0117 (6%) between $0.21 and $0.20 until October 14, 9:00 p.m. 15 8:00 p.m.

- Volume jumped to 568.6 million at 08:00 during the morning rally to $0.21 before sellers regained control.

- The largest liquidation occurred between 1:00 p.m. and 3:00 p.m. with a turnover of 920 million as the price fell below $0.21.

- The capitulation at 7:50 p.m. dropped the price to a low of $0.20 on volume of 12 million, marking likely exhaustion.

- DOGE stabilized near $0.20 in closing with reduced volume, hinting at an early return of demand.

Technical analysis

- Support remains firm around $0.20-0.202, consistent with high volume buildup during liquidation lows. Resistance lies between $0.21 and $0.214, with the area capped by morning reversal volume.

- The short-term structure remains fragile as DOGE trades below the 200-day moving average, but volume compression and steady supply depth at $0.20 suggest potential base strengthening. A net recovery of $0.21 could prompt long positions targeting $0.224 to $0.228.

- Momentum indicators remain oversold; derivatives funding has turned sharply negative on Binance and OKX – conditions often preceding short-covering rallies.

What traders are looking at

- $0.20 support – if bids absorb post-liquidation supply via Open Asia.

- Track volume on any $0.21 claim for reversal confirmation.

- Institutional positioning around Nasdaq-linked instruments from House of Doge.

- Broader risk sentiment around US-China trade headlines.