Strong selling pressure sends XRP down 2% before stabilizing near key support. Institutional positioning and new open interest suggest accumulation at current levels.

News context

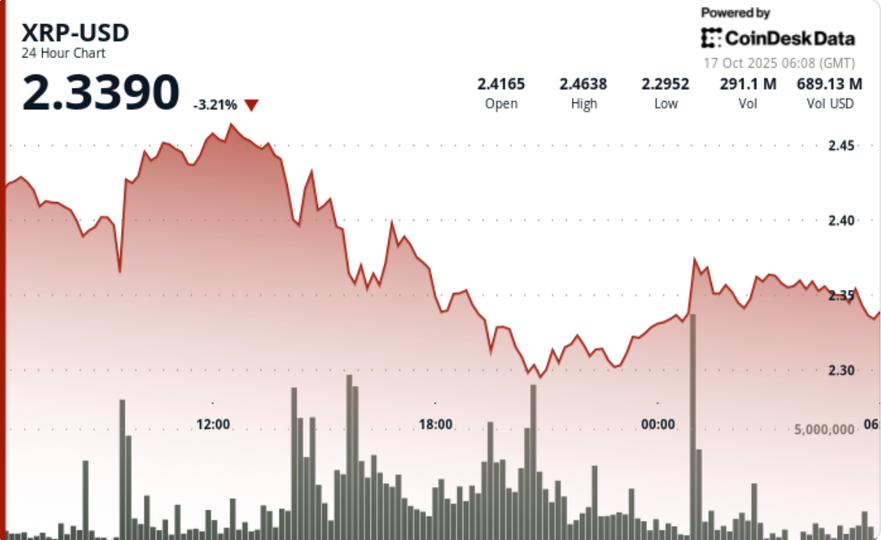

- XRP extended its decline during the October 16-17 session, sliding 2% from $2.41 to $2.36 amid an ongoing institutional sell-off. Market data shows daily volume of more than 150 million, with long-term holders reducing their positions by 34% over the past two weeks.

- Hodler’s measure of net position change fell from 163.7 million to 107.8 million tokens – a clear sign of a rotation in divestments following the mid-month volatility spike.

- Despite the decline, open interest rebounded to $1.36 billion as derivatives traders began to replenish their exposure following the weekend washout.

- Market desks say the surge in activity could mark the start of long tactical positioning on end-of-quarter ETF speculation and signals of macroeconomic easing.

Price Action Summary

- XRP traded between $2.31 and $2.47 over a 24-hour window, with a $0.16 band representing 7% intraday volatility.

- Selling intensified from 2:00 p.m. to 8:00 p.m., with the price falling 8% during the day, from $2.44 to $2.29, before recovering slightly at the US close.

- Significant volume reversals above $2.31 confirmed strong spot demand and weak algorithmic buying.

- Resistance remains capped near $2.47, where repeated rejections signal continued supply pressure.

- The last hour (04:34 to 05:33) showed consolidation from $2.35 to $2.36 with peak volume of 1.6 million – typical of controlled reaccumulation phases following forced unwinds.

Technical analysis

- XRP price structure is stabilizing in the $2.31-$2.47 range, with the $2.35 pivot acting as a short-term anchor. Volume clustering around this area indicates institutional accumulation despite the broader tone of risk aversion.

- A net recovery to $2.47 would invalidate the short-term bearish setup and open a path towards $2.55.

- Momentum indicators remain neutral or oversold, while funding rates have turned slightly positive – a sign that short-selling coverage has slowed. Analysts expect continued, volatile consolidation until macroeconomic risk diminishes or ETF flows accelerate.

What traders are watching

- $2.31-$2.35 support zone – base defense levels signaling buyer absorption.

- Reclaiming resistance at $2.47 – first reversal momentum confirmation trigger.

- Open interest and funding normalization – evidence of post-flush releveraging.

- ETF Timeline and Fed Comments as Catalysts for Crypto Flow Rotation in Q4.