XRP traded defensively but held key supports on Friday, recovering from an early decline to $2.19 as institutional buyers absorbed selling pressure. The move comes amid renewed fears over US-China tariffs and cautious positioning ahead of next week’s SEC deadlines for spot XRP ETFs.

What you need to know

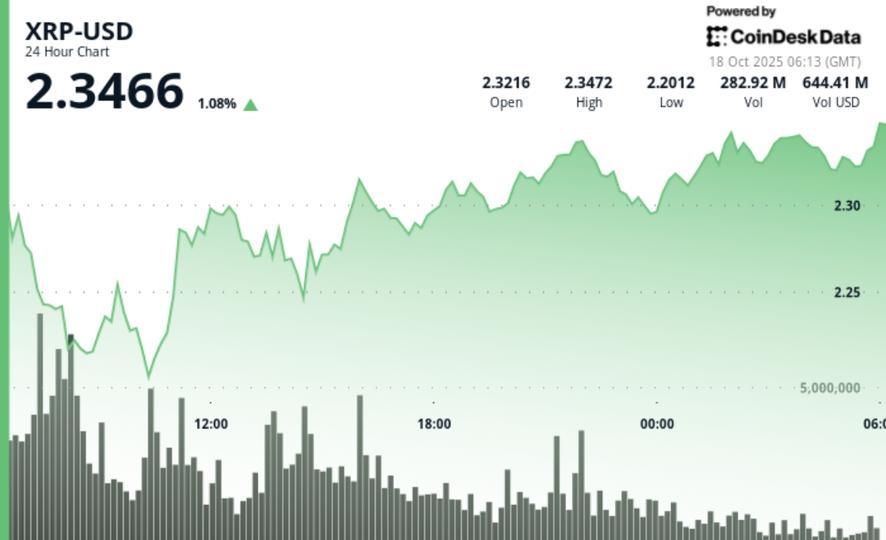

• XRP oscillated between $2.19 and $2.35 during the 24-hour session from October 17 at 6:00 a.m. to October 18 at 5:00 a.m., a range of 7%.

• Trading volume reached 246.7 million as of 7 a.m., nearly triple the 24-hour average, as sellers capitulated near $2.23.

• The price recovered from a low of $2.19 to settle at $2.33, registering a gain of 1% since the opening of the session.

• The broader cryptocurrency market capitalization fell 6% to $3.5 billion as macroeconomic tensions and trade rhetoric between the United States and China spurred risk-averse flows.

• The SEC’s review of six pending spot XRP ETF filings continues through October 25, alongside Ripple’s planned $1 billion fundraising.

News context

The early session decline reflected weakness in the digital asset complex as investors reduced exposure ahead of trade-related headlines and ETF deadlines. Despite a sharp morning decline from $2.33 to $2.19, XRP quickly stabilized as market depth restored on strong buying programs. Ripple’s billion-dollar fundraising initiative for its treasury division has boosted confidence, while analysts called the move a “controlled spin” rather than a structural weakness.

Price Action Summary

• XRP fell to $2.19 at 07:00 UTC on volume of 246.7 million, setting key intraday support.

• Bulls regained control mid-session, leading to a steady rise to resistance at $2.33 to $2.35.

• The last 60 minutes (04:22-05:21 UTC) saw a slight rise to $2.32 followed by a rebound to $2.33 (+1.8%), with a peak tick volume of 1.69 million.

• Consolidation between $2.32 and $2.34 formed the new short-term base, validating strong absorption near previous lows.

Technical analysis

• Support – $2.23 to $2.25 remains the key accumulation zone; Exposure below $2.20 continues to attract long-term interest.

• Resistance – rising intraday band caps from $2.35 to $2.38; A breakout confirmation is needed above $2.40.

• Volume – Peak at 246.7 million during sale; end-of-day surges (~1.7 million) signal the return of liquidity.

• Trend – Gradual upward bias after morning surge; Neutral RSI, stabilizing MACD.

• Structure – Short-term consolidation between $2.19 and $2.35 suggests reaccumulation ahead of potential ETF catalysts.

What traders are watching

• ETF approval window (October 18-25) and potential market price review once SEC decisions are made.

• If $2.30 provides basic support during weekend trading.

• Ripple’s continued $1 billion fundraising and potential secondary market implications.

• Broader risk sentiment as rising tariffs dampen altcoin liquidity.

• technical breakout above $2.40 as a signal for a rotation towards the $2.70-$3.00 range.