XRP is trading narrowly after a period of volatility, holding above near-term support as market participants assess further risk exposure. Strategists warn that a deeper pullback toward $1.55 remains plausible before an attempted structural recovery toward the $7-$27 corridor.

News context

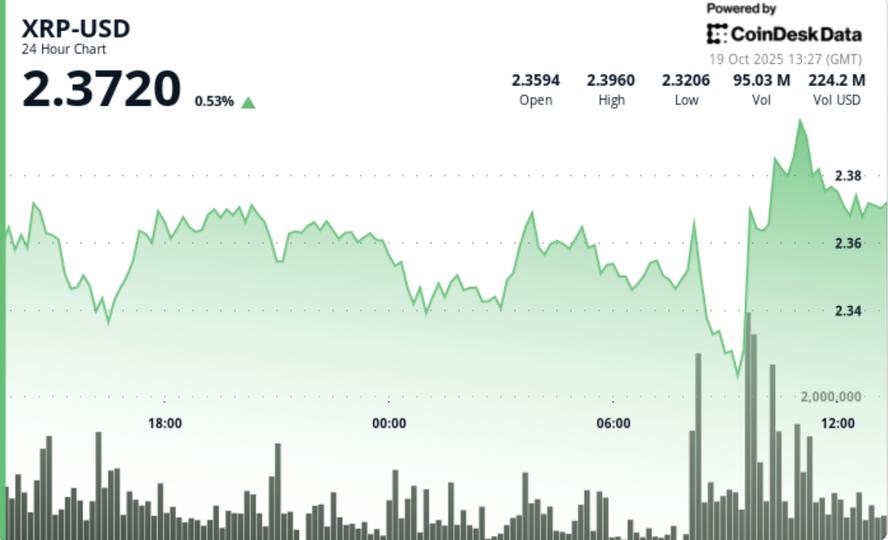

- The token stabilized throughout Thursday’s Asia-US crossover, consolidating between $2.34 and $2.39 after a strong rally earlier in the week.

- The midday rise to $2.39 on Oct. 18 attracted $42.23 million in volume, nearly double the 24-hour average, before fading into a narrow band near $2.35.

- Market sentiment remains cautious amid $19 billion in cryptocurrency cross-liquidations triggered by escalating trade tensions.

- Ripple’s proposed $1 billion capital raise and the SEC’s ongoing review of six XRP ETF spot filings continue to shape positioning. Institutional desks are reporting lighter leverage exposure and a rotation toward cash collateral as traders prepare for political headlines and macroeconomic catalysts.

Price Action Summary

- XRP moved in a compact 2% range during the October 18-19 session, reaching a low near $2.34. Bulls briefly retested the $2.39 high before sellers reloaded.

- Volume slimmed throughout the second half of the day – a classic pre-break squeeze.

- The last hour (07:10-08:09 UTC) saw XRP rebound from $2.34 to $2.35 on a $590,000 turnover, suggesting that the earlier demise may have been a false breakout rather than a clear trend reversal.

Technical analysis

- The price structure remains neutral to bullish while XRP trades above the $2.34 support. Intraday action shows a pocket of accumulation forming in the $2.34 to $2.35 band, with clear resistance anchored near $2.39.

- Momentum patterns show declining volatility and a reset of the RSI after prior excessive extension.

- A decisive break above $2.39 reopens $2.47, while failure to hold $2.34 exposes the cluster from $2.28 to $2.31. Longer-term technicians point to a potential 40% correction towards $1.55 if general risk-off sentiment intensifies – a move that could set the stage for the next cyclical advance.

What traders are watching

- Bureaus are monitoring ETF headlines through October 25 as potential volatility kicks in. A recovery of $2.40 with volume confirmation could trigger the next wave towards $2.65.

- Macro traders remain cautious about developments in U.S.-China tariffs and the Fed’s rhetoric on liquidity – both seen as catalysts for the next impulse move.