DOGE is stabilizing after a volatile week, rising through Friday as desks see renewed interest from institutional and corporate wallets. Volumes remain strong, but the band looks cleaner – with buyers defending the $0.188 base with conviction. Traders say the positioning is gradually turning positive this weekend.

News context

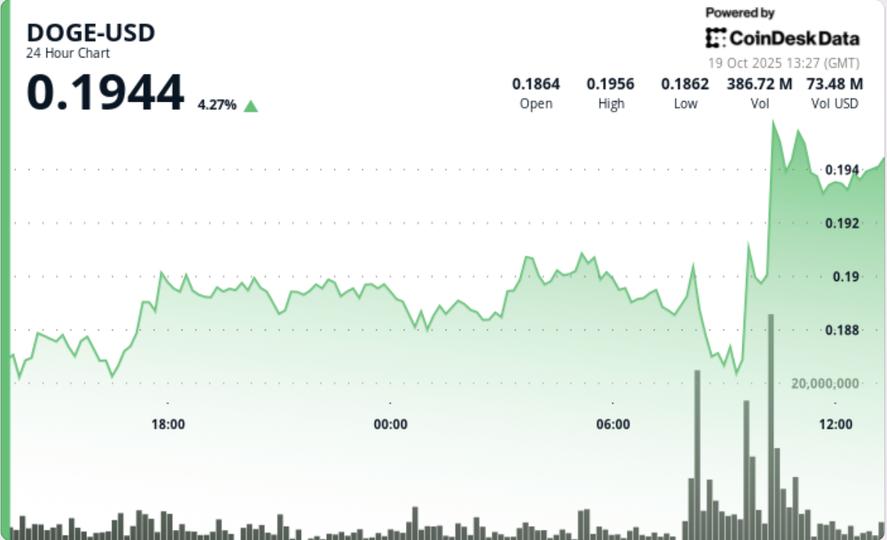

- DOGE’s rebound comes as broader risk assets stabilize after heavy midweek selloffs. The meme token added around 3% in the 24 hours to 08:00 on October 19, trading from a low of $0.186 to a high of $0.191.

- Market talk indicates further inflows related to cash allocation pilots following House of Doge’s debut on Nasdaq, attracting corporate curiosity for crypto balance sheet exposure early on.

- Institutional desks reported a breakout around 5:00 p.m. UTC on Thursday as DOGE rose from $0.187 to $0.191 on 276 million volume, four times its average.

- The push marked the first compelling high-volume bid since last week’s trade war and set $0.188 as new support.

Price Action Summary

- DOGE’s 24-hour range reached around 3% between $0.186 and $0.191, with bulls remaining in control throughout the US session.

- Price action flattened through the end of the day in Asia, with volumes decreasing – a classic sign of passive accumulation rather than forced liquidation.

- The final hour saw a brief decline to $0.188 before a quick recovery to $0.190 on a burst of 8.7 million volume, confirming interest from algorithmic buyers defending the line.

Technical analysis

- The price structure remains constructive above $0.188. Momentum bias becomes positive as funding normalizes and short exposure dissipates.

- A decisive push up to $0.192 opens the way towards $0.197 – $0.200 – the upper limit of last week’s distribution zone.

- Failing to hold $0.188 would re-expose supports at $0.182 to $0.180, but flow data suggests bids remain firm below the spot.

What traders are watching

- Traders are eyeing a sharp breakout at $0.192 to confirm the continuation of the trend. On-chain trackers show that moderate whale influxes are resuming after the distribution earlier this month.

- Treasury office activity remains the wild card – any tracking of corporate accumulation could make this a lasting base rather than a dead-end rebound.