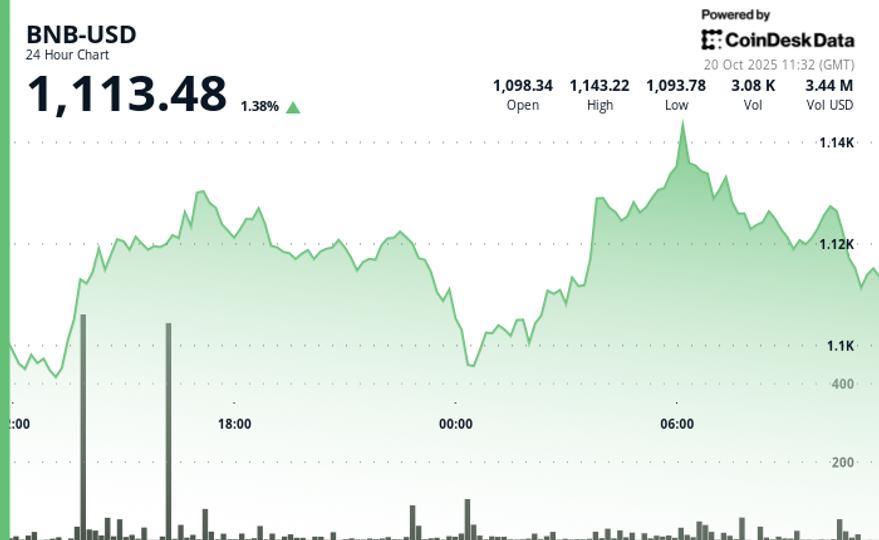

BNB, the native token of the BNB Chain, is up 1.4% over the past 24 hours, despite sharp swings that saw its price move within a 7% range during a high-volume session, according to CoinDesk Research’s technical analysis data model.

The gain comes amid a rally in risk assets that saw Bitcoin rise 2.6% in the past 24 hours, while the broader crypto market rose 2.5% based on the CoinDesk 20 Index (CD20) after US President Donald Trump softened his stance on tariffs and amid signs the Federal Reserve may ease its quantitative tightening program in the near future.

BNB opened the session near $1,077 and climbed as high as $1,144 before paring its gains. This advance coincided with an increase in trading volume, which reached 128,847 tokens, almost double the 24-hour average.

After a decline to around $1,090, buyers stepped in again before resistance capped the move near $1,144. BNB then saw a pullback as the token fell from $1,128 to $1,122, reflecting slowing momentum.

Last week, Coinbase added the token to its list of assets under review for full platform support, as part of its new “Blue Carpet” initiative to expand retail access to more tokens. Around the same time, China Merchants Bank International (CMBI) tokenized its US dollar money market fund on the BNB chain, issuing two tokens – CMBMINT and CMBIMINT – to accredited investors.

Traders anticipate a 25 basis point interest rate cut from the Federal Reserve this month, while signs of easing trade tensions between the United States and China have boosted risk appetite.

On the other hand, growing geopolitical tensions are weighing on risky assets. Despite the rebound, sentiment remains cautious. The Crypto Fear & Greed Index is at 30, meaning sentiment remains in the “fear” zone.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.