Bitcoin peaked at around $103,500 on Friday, marking an 18% correction from its all-time high of $126,200 reached on October 6. This corresponds to a standard bull market correction, where bitcoin typically retraces by around 20% a trend that has defined the current cycle since it began in 2023.

According to analyst Checkmate, the main source of selling pressure in the market comes from existing bitcoin holders.

“The extent of selling pressure from existing bitcoin holders is still not widely appreciated, but it has been the source of resistance. No manipulation, no paper bitcoin, no deletion. Just good old-fashioned sellers,” Checkmate noted.

The first chart illustrates the recovery in supply, which refers to the total amount of coins returning to circulation after being inactive for a period of time. Restored supply recently reached its second highest level of the cycle, at $2.9 billion per day.

Notably, 47% of the selling pressure came from coins held for six months to a year, suggesting that many investors who purchased Bitcoin in late 2024, and particularly during its fall to around $76,000 in April following tariff-related market reactions, are now making profits.

The second chart highlights a similar trend across the average age of coins spent, which has continued to increase throughout this cycle. At the start of the cycle in 2023, the average age of coins spent was 26 days, a relatively young age, but it has now increased to 100 days. This indicates that older coins are increasingly being spent as their holders choose to make gains.

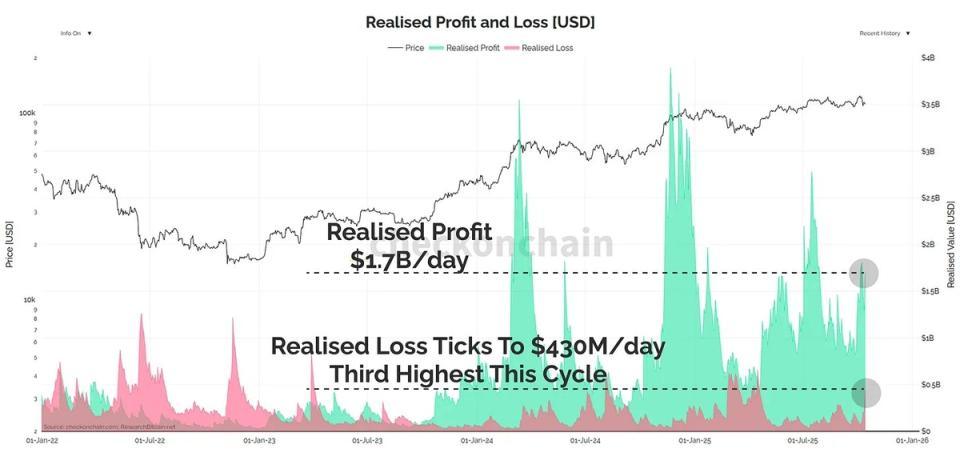

Supporting this profit-taking narrative, Checkmate also shows that realized profits jumped to around $1.7 billion per day, one of the highest levels ever seen during this cycle. At the same time, realized losses also climbed to $430 million per day, the third highest level in the cycle, a high level of capitulation.

Overall, the data suggests that profit-taking remains the dominant market behavior, and this continued selling pressure is weighing on the price of Bitcoin.