DeFi lender Aave’s governance token rebounded more than 2% early Wednesday above $220, reversing early losses amid a new community proposal for a $50 million token buyback initiative.

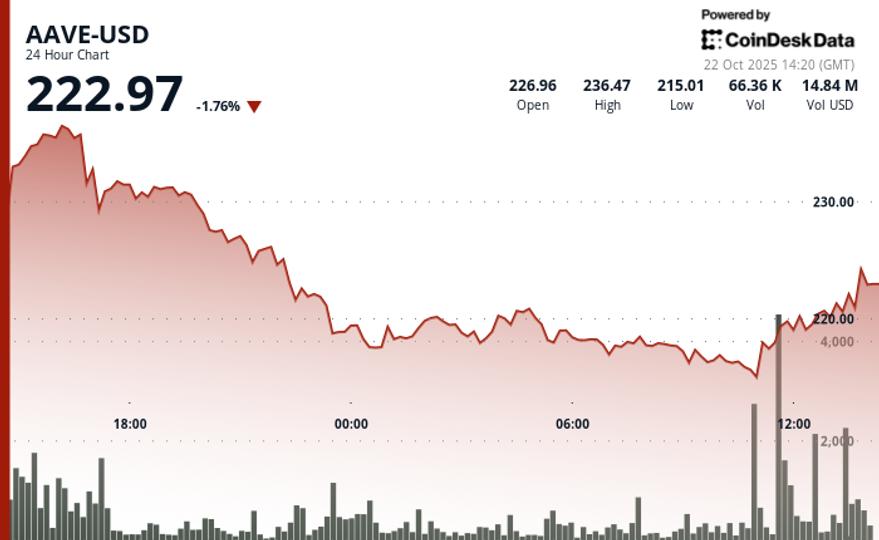

The move follows a volatile session in which prices oscillated more than 10% in an intraday range of $22.55, with AAVE rebounding sharply from the session low of $214.25, CoinDesk Research’s analysis model showed. Along with the price action, the token saw a 23.68% increase in trading volume compared to the weekly average. Despite the rebound, the token was still down 5% from Tuesday’s session high.

While the move reflected the broader crypto market’s modest rebound from overnight lows, it also coincided with a new governance proposal that could reshape AAVE’s long-term token economy.

The Aave Chan Initiative (ACI), led by Marc Zeller, proposed on Wednesday a permanent $50 million annual buyout program funded by revenue from the loan protocol. The plan would expand Aave’s current buyback program and allow for adaptive weekly purchases worth between $250,000 and $1.75 million of AAVE, depending on market conditions.

Supporters said the program would create constant buying pressure, recycle idle treasury assets, and stabilize the token’s market dynamics. This marks a step towards the institutionalization of “Aavenomics” as a central part of the protocol’s long-term business model.

Technical analysis

Key technical levels signal consolidation for AAVE, CoinDesk Research’s model suggests. AAVE now faces near-term resistance at $236.80, with support between $215 and $220. Price developments could remain limited unless governance dynamics or macroeconomic trends further shift demand.

- Support/Resistance: Primary support holds at the $215-$217 area with resistance at $236.80; new short-term support formed at $220 following increased volume.

- Volume Analysis: 24-hour volume climbed 23.68% above the seven-day average with peak activity of 128,661 units on October 22 at 11:00 a.m., or 124% above the 24-hour simple moving average.

- Chart Patterns: Limited consolidation in the $22.55 trading range (10.1% volatility) with a dramatic intraday reversal from the session low of $214.25.

- Targets and Risk/Reward: Immediate resistance at the $236.80 level with confluence of support around the $215-220 area providing defined risk parameters for position management.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.