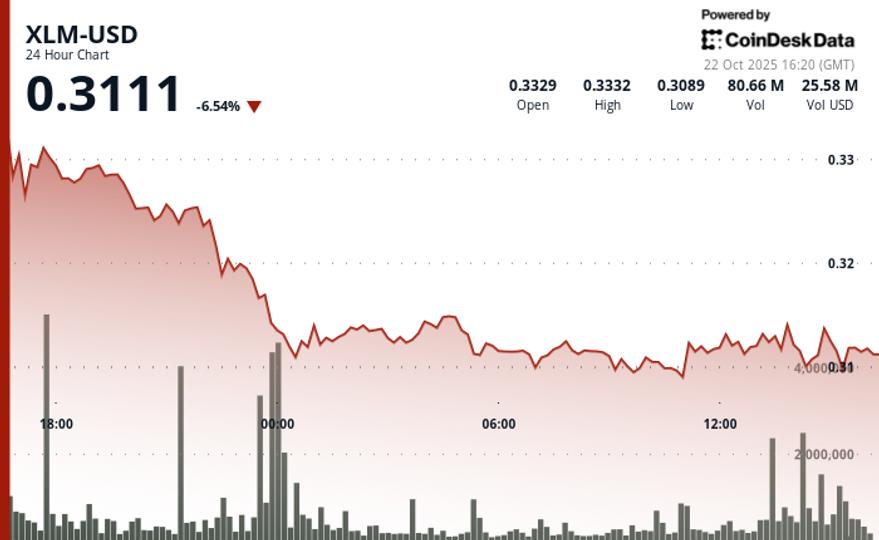

Stellar’s XLM fell 5% on Tuesday from $0.3284 to $0.3119 after falling below a critical support level of $0.32 that had held for weeks. This is one of the biggest declines for XLM in recent sessions, highlighting renewed bearish momentum in a market largely driven by technical factors rather than fundamentals.

The selling accelerated around 3:00 p.m. Monday, as volume reached 53.9 million, about 74% above the 24-hour average of 21.6 million, signaling increased selling pressure. The failure to reclaim $0.32 despite multiple rebound attempts confirmed a decisive technical breakdown, with the token now struggling to stabilize near $0.3116.

Data shows that selling intensified in the early afternoon, pushing XLM as high as $0.311. However, support has started to form near $0.3100, and repeated testing suggests that institutional buyers may be piling in. Analysts view this level as the last line of defense before deeper declines.

This move was largely technical in nature, with algorithmic selling triggered by the $0.32 breakout and increased participation from European traders adding to the bearish momentum. Market watchers are now monitoring whether XLM can hold above $0.3100 – failure in this case could open the door to further weakness in the near term.

Key Technical Levels Signal Continued Pressure for XLM

Support/Resistance:

- Critical floor at $0.3100 with several successful tests during Asian hours.

- Key resistance reestablished at $0.3337 after a high volume rejection session.

- The immediate battle zone is centered at the $0.3116 consolidation zone.

Volume analysis

- The volume explosion to 53.9 million exceeded the 24-hour average by 74% during the outage.

- The sales peak reached 1.7 million at 1:58 p.m. time candle before stabilization.

- The accelerating volume of European sessions suggests continued institutional interest.

Chart templates

- Clear breakdown pattern with consecutive lower highs set over 24 hours.

- A dramatic reversal from the $0.313 resistance confirms a change in bearish momentum.

- The consolidation pattern at $0.3116 provides a short-term stabilization signal.

Objectives and risk/reward:

- Immediate Support Cluster: $0.3100-$0.3116 area critical for bulls.

- Wall of resistance: $0.3284 to $0.3337 limits any recovery attempts.

- Downside target: a move below $0.3100 opens the door to accelerated selling.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team to ensure accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.