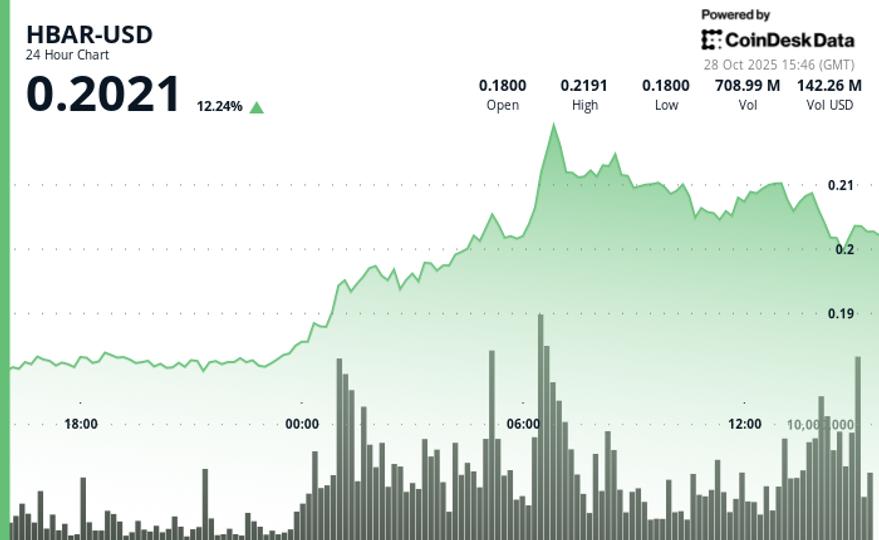

HBAR surged 25.7% over 24 hours from $0.1775 to $0.2052 as trading volume soared 182% above the daily average. The rally coincided with the launch of Canary Capital’s HBAR spot ETF (ticker: HBR) on the NYSE, following SEC approval.

This debut marked an important milestone for institutional access to Hedera, offering regulated exposure through BitGo and Coinbase Custody, with pricing data sourced from CoinDesk indices. This development placed HBAR alongside Bitcoin and Ethereum in the list of institutionally tradable digital assets.

The breakout began around 6:00 a.m. on October 28, when HBAR decisively broke through the $0.2060 resistance level that had limited previous advances. Strong buying support emerged at the psychological $0.2000 level, maintaining the bullish momentum throughout the European session. The token consolidated above $0.2050, reflecting steady accumulation following the ETF-led rally.

However, late session trading revealed signs of institutional distribution as HBAR moved from $0.209 to $0.205, breaking below its $0.206 support. High sales volumes confirmed profit-taking by large holders, suggesting near-term exhaustion after the strong rally. This breakout introduces the risk of a retest of the $0.200 level, a critical area for preserving the bullish structure.

Key technical levels signal mixed outlook for HBAR

Support/Resistance

- Main support: $0.2000 (psychological level)

- Secondary support: $0.1950

- Key resistance: $0.2060 (breakout level)

- Additional resistance: $0.2100 – $0.2192 (selling pressure zone)

Volume analysis

- 182% increase above 24-hour SMA – signals institutional interest during breakout phase

- Volume decline during consolidation phase

- High selling volume during recent pullback – suggests profit-taking activity

Chart templates

- Uptrend with several higher lows over the 24 hour period

- A break below the $0.206 support indicates a potential double top formation near $0.209.

Technical analysis

- Rising targets:

- $0.2100

- $0.2192 (session highs)

- Depends on reclaiming $0.206 support

- Downside risk:

- Towards $0.2000 in psychological support (decrease ≈ 2.5%)

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.