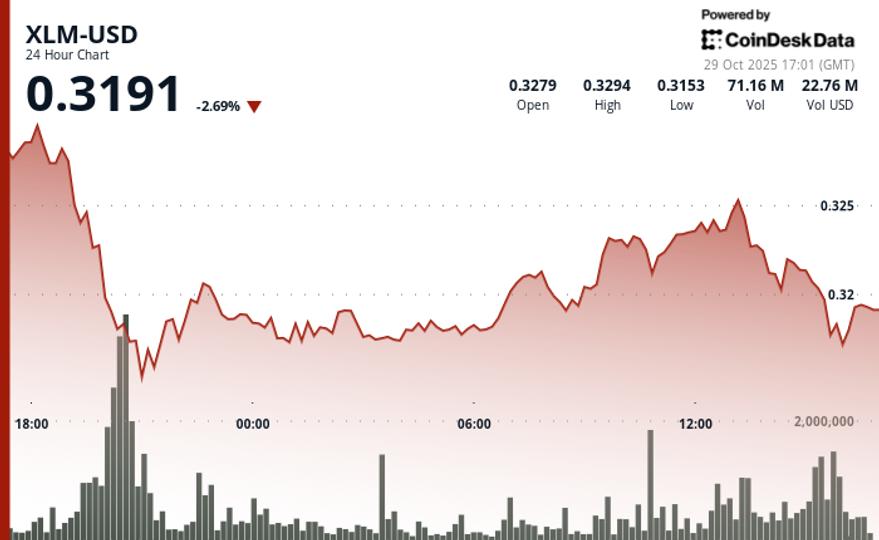

Stellar Lumens (XLM) gained 1.53% over the past 24 hours, rising from $0.3168 to $0.3177 as trading volume surged 134% above its 30-day average. Controlled price action amid high volume indicates institutional accumulation rather than retail-driven momentum.

XLM slightly outperformed the broader crypto market by 1.23%, consolidating between $0.315 and $0.325 after rebounding from a low of $0.3162. The decrease in near-term volume suggests that the distribution has softened, with strong support forming above $0.32 ahead of the upcoming Protocol 24 upgrade.

Increasing volumes without strong price fluctuations indicate stable institutional buying, often a precursor to lasting breakouts. Meanwhile, Stellar’s ecosystem continues to grow, reaching $639 million in tokenized assets, a 26% monthly increase, led by Franklin Templeton’s $446 million tokenized treasury fund.

XLM Technical Presentation

- Support/Resistance

- Main support: $0.316

- Immediate resistance: $0.325

- Wider range: $0.31 – $0.33

- Volume analysis

- 134% increase above 30-day average volume

- Occurred alongside modest price gains

- Indicates institutional accumulation rather than retail speculation

- Chart templates

- Obvious volume-price difference

- Suggests controlled purchasing activity

- Indicates potential volatility expansion ahead

- Targets and risk/reward

- A break above $0.325 could target a range of $0.35 to $0.40.

- Downside risk limited to $0.31 support zone

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance. our standards. For more information, see CoinDesk Comprehensive AI Policy.