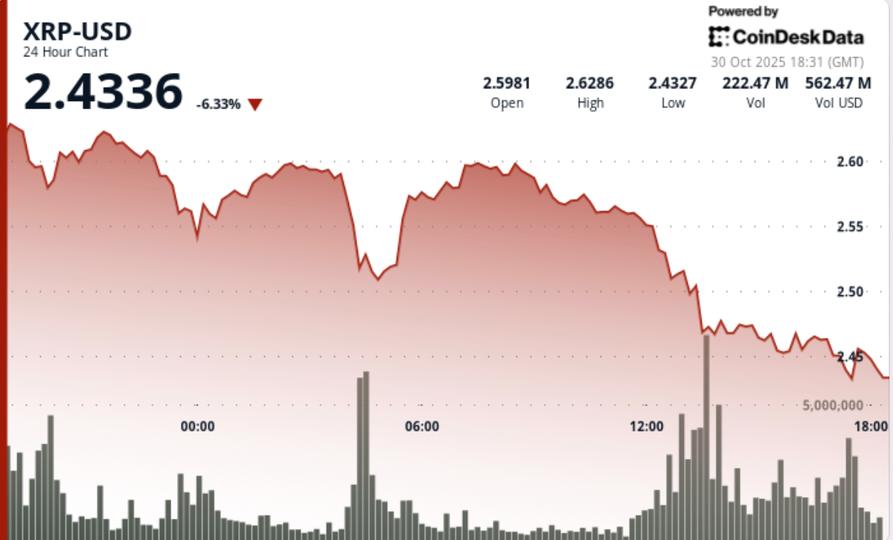

Le XRP a plongé de près de 8 % au cours de la séance de jeudi alors que les ventes institutionnelles se sont accélérées suite à de multiples pannes à volume élevé, dépassant le niveau de support critique de 2,46 $ qui avait ancré la fourchette de consolidation d’un mois.

News context

- XRP fell sharply from $2.65 to $2.48 amid aggressive selling pressure as macro and technical factors aligned against it.

- The broader crypto market reacted negatively to hawkish signals from the Federal Reserve, even as the U.S.-China trade outlook showed signs of improvement.

- At the same time, technical analysts reported a confirmed bearish pattern after a key support level failed to hold.

Price Action Summary

- XRP crashed by around 6.4% over a 24-hour period, from around $2.65 to around $2.48.

- The outage was accompanied by disproportionate volume, peaking around 392.6 million tokens, almost 400% of its daily average.

- The decisive breakout occurred after several support areas failed to hold, with the critical $2.46 level breached and the $2.48 low tested.

- The decline was accompanied by two waves of intense selling, and the final leg of the decline occurred on minimal volume, indicating exhaustion and institutional exit.

Technical analysis

- The chart structure shows a clear bearish breakdown from an ascending or neutral consolidation pattern.

- Support at ~$2.46 has broken down, turning into resistance. Momentum indicators (e.g. RSI and MACD) indicate weakening conditions and a confirmed sell signal scenario.

- The volume profile – with an extremely high peak in the fall and moderate recovery volume thereafter – suggests distribution (selling) rather than healthy accumulation.

- Key levels to watch now are resistance near ~$2.46 to $2.50 and downside targets between ~$2.30 and $2.40 if current support breaks.

What Traders Should Know

- Traders should treat current levels with caution. A sustained rebound above ~$2.50 could provide relief, but confirmation of the breakout means the bears currently hold the advantage.

- If XRP fails to reclaim the ~$2.50 – $2.46 zone, the path to ~$2.30 or lower becomes more likely.

- Chain whale flows and futures open interest (which may show further weakening) should be closely monitored as further confirmation of structural risk.

- Favorable macroeconomic factors (trade news, regulatory developments) may still trigger a recovery, but the technical framework currently favors continued weakness until significant support is re-established.