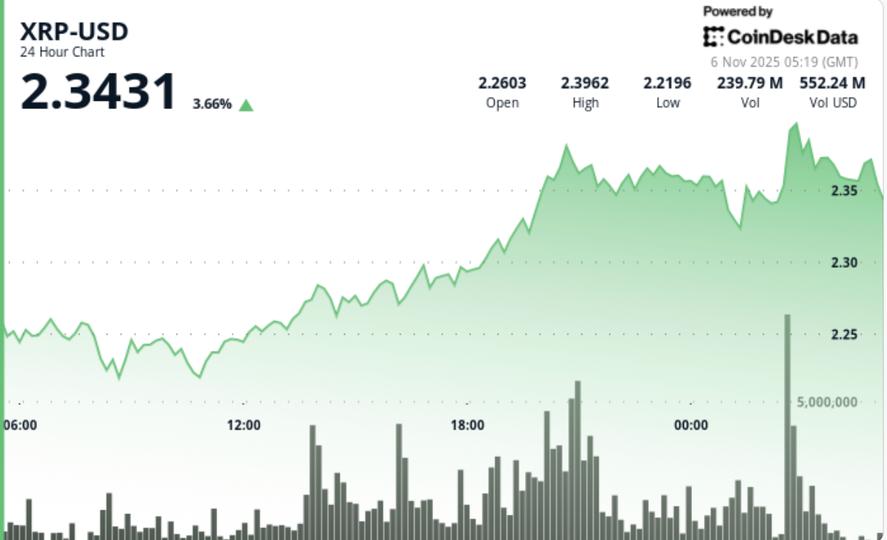

XRP rose 4.9% to $2.35 during Tuesday’s session, breaking through key resistance at $2.30 on nearly double institutional volume. This is the token’s biggest daily gain in a week and an outperformance against a broader declining market, with traders now eyeing a sharp push towards $2.50.

News context

- Institutional flows returned to XRP as risk assets corrected elsewhere, with large holders accumulating near $2.30 after a week of squeeze. Three consecutive hourly candles broke through resistance on rising volume, signaling conviction-driven breakout behavior.

- To add to the sentiment, Ripple, Mastercard, WebBank, and Gemini jointly launched a stablecoin-based settlement pilot using RLUSD on the XRP Ledger to process fiat credit card payments.

- The initiative is one of the first tests by a regulated U.S. bank to settle real-world card transactions directly on a public blockchain. RLUSD, which recently surpassed $1 billion in circulation, operates under the New York Trust Charter, providing a regulated framework for stablecoin-backed payment rails.

- Traders interpreted the pilot as a potential validation of Ripple’s infrastructure beyond cross-border remittances – expanding business use cases at a time when stablecoin settlements are becoming the preferred on-chain banking mechanism.

Price Action Summary

• Breakout sequence triggered after $2.30 recovery on 164M volume

• Session high hit $2.39 before slight profit-taking

• Support now anchored at $2.32; previous resistance has become the basis

• Momentum maintained during the consolidation of the last hour between $2.34 and $2.35.

• XRP recorded higher highs and maintained a clean breakout channel.

Technical analysis

• Trend: bullish reversal confirmed by higher low formation

• Support: $2.32 (new base), $2.21 (secondary)

• Resistance: immediate barrier from $2.38 to $2.39; target increase from $2.50 to $2.60

• Volume: 95% increase over 24-hour average confirms institutional conviction

• Momentum: RSI rising, no signs of exhaustion yet

• Structure: clear break above the previous consolidation; intraday volatility 7.4%

What traders are looking at

• If XRP can sustain closes above $2.35 and turn $2.38 to $2.39 into support.

• Continuing RLUSD-led institutional narrative as Mastercard tests on-chain settlements

• Volume consistency after breakout – key to confirming fund-driven tracking

• Risk of falling towards $2.30 if momentum runs out of steam

• ETF and regulatory updates through mid-November that could strengthen bullish flows