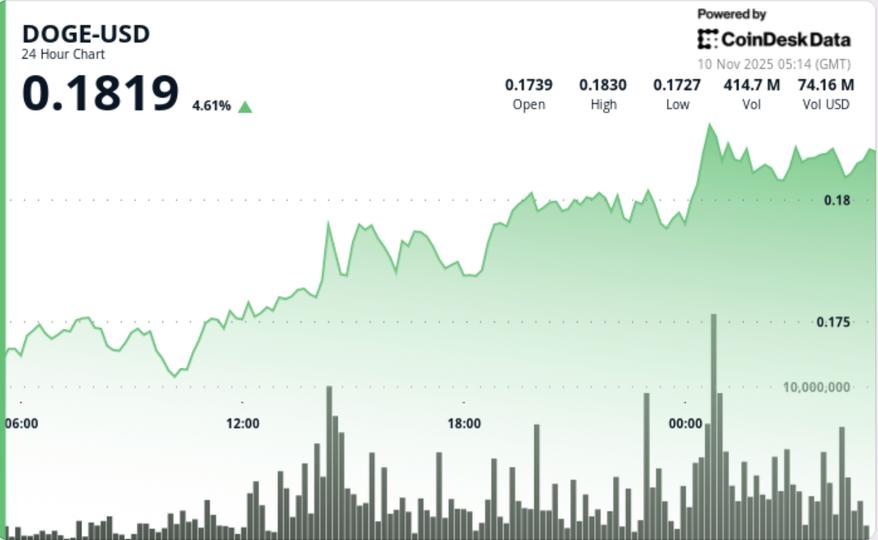

Dogecoin rose 5.2% to $0.1811 on Tuesday as institutional buying accelerated past the key resistance level of $0.1800.

The move comes amid stronger risk sentiment following comments by US President Donald Trump over the weekend calling tariff supporters “fools” while pledging to use tariff proceeds to fund $2,000 dividends for Americans – remarks that spurred a rotation into speculative assets and risky trades.

News context

- DOGE’s breakout coincided with a rebound in coin sentiment on major exchanges. The sector attracted renewed attention as traders repositioned towards higher beta tokens following a four-day consolidation.

- Volume surged to 649.5 million, marking a 180% increase above the 24-hour average, confirming institutional accumulation during the move. The rally pushed DOGE decisively through the $0.1800 resistance – a level that had capped bullish momentum since early October.

- The macro context added additional intrigue. Trump’s populist remarks reignited expectations for easing fiscal conditions and increased domestic liquidity – themes historically correlated with the appetite for speculative risk in digital assets.

- Traders cited parallel inflows into the DOGE and SHIB markets, indicating a coordinated rotation into meme-related assets.

Price Action Summary

- DOGE rallied from $0.1722 to $0.1811, trading within a range of $0.009, which marked its biggest intraday expansion in over a week. Buyers repeatedly defended the $0.1742 level before initiating a rise to $0.1800.

- The breakout materialized during the New York morning session as volume increased sharply, confirming institutional execution across key trading pairs.

- The price peaked at $0.1826 before encountering short-term resistance. A slight pullback to $0.1804 followed, forming the first retest of the breakout zone.

- Hourly charts revealed strong accumulation volume at mid-levels, suggesting that structural support has shifted higher.

Technical analysis

- The break above $0.1800 validates a short-term bullish reversal trend after a multi-session base building phase. Momentum indicators remain constructive, with an upward trend in the RSI close to 61 and a move in the MACD into positive territory.

- Volume analysis shows dominant accumulation patterns early in the session, while late day hourly turnover peaks at 24 million (≈300% above average) reflected profit taking rather than structural weakness.

- The chart structure confirms higher lows at $0.1745, $0.1761, and $0.1782 – the hallmark of an emerging ascending channel. DOGE is now trading firmly above its 20 and 50 hour moving averages, highlighting the strength of short-term momentum.

What Traders Should Know

- DOGE’s ability to hold above the $0.1800 to $0.1804 support zone will determine whether the breakout develops into a sustained uptrend.

- A confirmed daily close above the $0.1838 resistance could pave the way for an increase towards $0.1860 – $0.1900.

- Failure to maintain current levels risks a pullback towards $0.1740-0.1750, although institutional accumulation suggests declines may continue to attract buyers.

- Analysts point to the meme coin sector as an emerging speculative proxy amid macro uncertainty. Trump’s renewed fiscal rhetoric adds another potential volatility factor – one that could amplify flows into high-beta digital assets if policy optimism continues through mid-November.