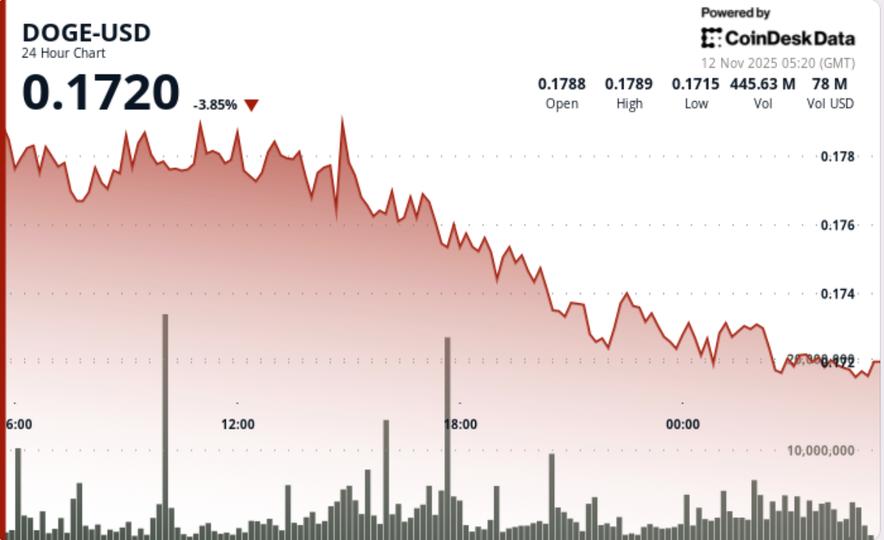

Memecoin fell below the critical $0.1720 level on heavy volume as sellers dominated the US session, testing the resilience of long-term technical support.

News context

- Dogecoin extended its decline on Tuesday, falling 5.5% from $0.1831 to $0.1730 as bearish momentum accelerated during European trading hours.

- The sharp move took place within the $0.0121 range as the price action confirmed a classic lower and lower level formation.

- Strong selling emerged at the $0.1789 resistance area, triggering a cascade of successive support levels until buyers stabilized the move near $0.1719.

Price Action Summary

- DOGE’s session structure reflects deteriorating momentum with declining support strength.

- Failure to reclaim resistance at $0.1789 validates a short-term bearish trend, while the squeeze around $0.1730 highlights uncertainty among short-term traders.

- The $0.1719 area has absorbed several retests, forming a fragile base that could define the next pivot for directional traders.

- Declining volumes from peak levels portend temporary seller exhaustion, but without further buying, the market remains vulnerable to another downside test.

Technical analysis

- In the absence of major fundamental triggers, price action remains purely technical.

- DOGE’s breakout below its short-term moving averages reinforces the broader bearish bias that has persisted since early November. The hourly RSI is near 38, indicating slightly oversold conditions but no capitulation yet.

- Market analyst Kevin (@Kev_Capital_TA) highlights the weekly 200-EMA near $0.16 as Dogecoin’s “structural line in the sand.”

- This level has been maintained during six new tests since the summer, marking the limit between a cyclical decline and a reversal of the long-term trend.

What Traders Should Know

- The immediate focus is whether the $0.17 handle can hold under continued pressure. Measures of institutional order flow suggest systematic risk reduction rather than panic liquidation – leaving room for a technical rebound if volume continues to decline.

- Failure of the support cluster at $0.1720 to $0.1719 could expose the $0.1650 to $0.1600 zone, where the weekly moving average provides last resort structural support.