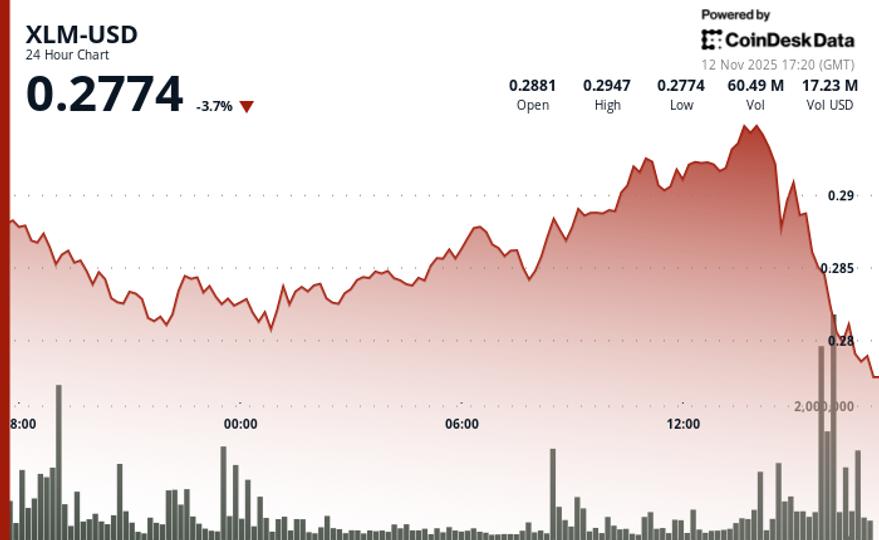

Stellar’s performance was subdued during Tuesday’s session ending November 12 at 2:00 p.m. UTC, with XLM falling from $0.2949 to $0.2944 as traders settled into a tight consolidation range.

The token’s modest $0.0148 move, or about 5% of total activity, highlighted uncertainty among market participants, suggesting a lack of directional conviction.

A wave of massive selling hit late on November 11, with volume reaching 36.08 million tokens, 47% above the 24-hour average, forcing a break below key support at $0.2845. The selling pushed XLM to a low near $0.2810 before buyers stepped in to stabilize prices.

With few Stellar-specific catalysts in play, traders are focusing on technical levels. The accumulation near the $0.2949 area and increasing volume suggests that institutional players may be positioning themselves to head towards the next resistance group between $0.2960 and $0.2970. The key question is whether the base around $0.2810 can hold strong to support a sustained push higher.

Key Technical Levels Signal Mixed Outlook for XLM

Support/Resistance:

- Main floor established at $0.2810 after a breakdown due to volume.

- Key resistance $0.2950 reclaimed during latest 60-minute breakout pattern.

- Next upside target zone positioned between $0.2960 and $0.2970.

Volume analysis:

- A massive volume spike of 36.08 million (47% above the SMA) marked a failure of support.

- The increase in volume during the retest of $0.2949 signals an institutional accumulation phase.

- The normalized activity in the last hours confirms the completion of consolidation.

Chart templates:

- The initial descending trendline from the session high created a bearish setup.

- A narrow range from $0.2810 to $0.2950 suggests a basic building structure.

- A sequence of higher highs/higher lows appears over a 60 minute period.

Targets and risk/reward:

- Immediate bullish target: resistance zone $0.2960 to $0.2970.

- Critical Support Defense: Basic formation low level of $0.2810.

- The risk/reward ratio is bullish above the breakout trigger of $0.2917.

Disclaimer

Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.