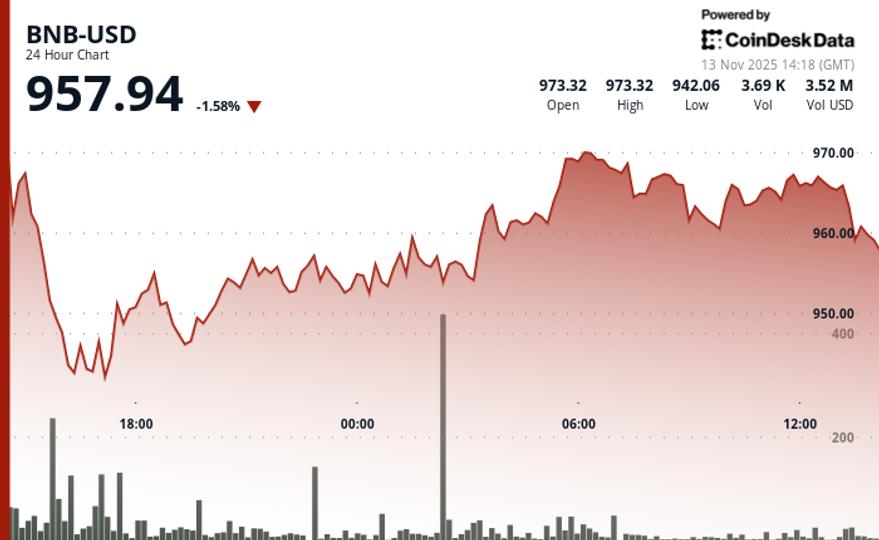

The native token of the BNB chain, BNB fell below $960 over the past 24 hours, giving up gains after encountering resistance just above $970.

The token’s price briefly rose to a high of $970.03, falling again. Volume increased sharply during the reversal, suggesting that large-scale sell orders triggered a cascade of liquidations, according to CoinDesk Research’s technical analysis data model. The price fell to a session low of $942.06 before recovering.

The change in momentum has left the token range-bound as buyers attempt to stabilize BNB around the $950-$960 area. The token is holding near the lower end of its intraday range, signaling continued caution from traders.

“BNB’s breakout below $970 is not so much due to its volatility, but rather a change in order flow dynamics,” Alex Boruski, co-founder of the BNB-related iMe AI project, told CoinDesk in an emailed statement. “With liquidity pockets below $950, the path of least resistance remains to the downside.”

BNB is stuck between a clear resistance level near $970 and near-term support near $942. Boruski pointed to the formation of a head-and-shoulders pattern on shorter timeframes, a pattern often seen as a sign of potential downside ahead.

Other analysts on social media have pointed out similar trends, conveying short-term bearish pressure affecting the cryptocurrency.

Whether BNB can regain ground above $970 or drop towards support levels around $900 could shape its next major move. For now, the decline is in line with that of the broader crypto market. The CoinDesk 20 Index (CD20) fell 1.6% over the period.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.