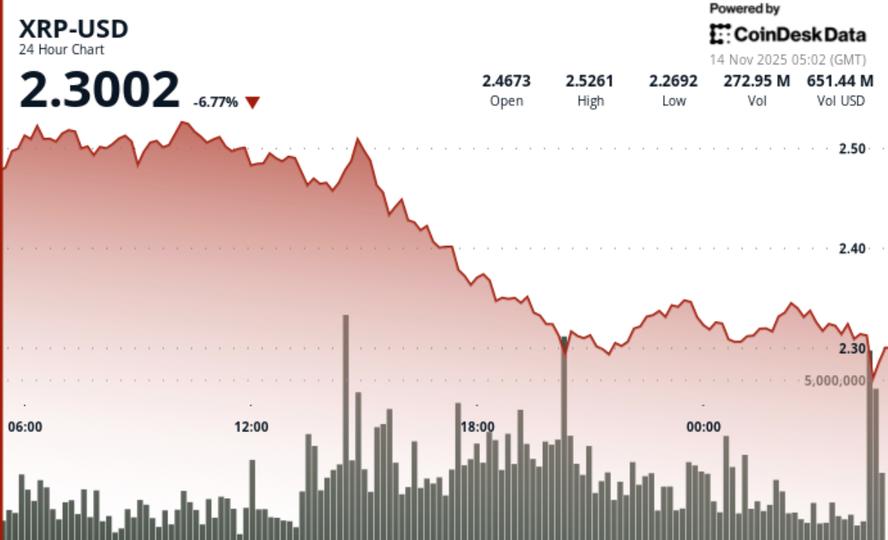

The sharp sell-off breaches the psychological low of $2.30, erasing recent gains as distribution overwhelms XRPC’s historic debut.

News context

XRP’s worst intraday decline in weeks coincided with a major industry milestone: the launch of the first US spot XRP ETF, Canary Capital’s XRPC, now officially live on Nasdaq at 5:30 p.m. ET. The listing marks a turning point for institutional access to XRP, but the debut came as broader crypto markets extended their medium-term downtrend.

The feeling remains pinned to fear in a context of persistent macroeconomic risk aversion. Analysts, including FxPro’s Alex Kuptsikevich, warn that crypto conditions still resemble “a short-term rebound within a larger decline,” with market structure vulnerable to deeper retracements. Large-cap token flows echo this caution, and XRP on-chain data showed that 110.5 million tokens were moved between unknown wallets in the hours following the outage, amplifying uncertainty during spikes in volatility.

Price Action Summary

XRP crashed 7.3% from $2.48 to $2.30 during the 24-hour session, breaking through major support levels at $2.46, $2.40, and $2.36. The decline spans a violent $0.23 range, with 157.9 million XRP traded, 46% above the 24-hour average.

The main breakdown occurred during a four-minute liquidation cascade from 04:32 to 04:35 UTC, when the price plunged from $2.313 to $2.295 on volume of 6.6 million XRP – 254% above the baseline. The one-minute peak of 4.06 million at 04:32 marked the high point of the selling session. Liquidity briefly evaporated as trading stabilized between 04:35 and 04:36, indicating either halted order flow or a sharp decrease in the portfolio.

Attempts to stabilize above $2.31 failed and XRP settled into a narrow consolidation near $2.30 to $2.32.

Technical analysis

The session confirmed a complete technical failure with obvious structural damage:

Support/Resistance:

• $2.29 to $2.30 becomes the main support after a breakdown of the psychological floor

• Former support at $2.36, $2.40And $2.47 now acts as a stacked resistor

• The invalidation of bulls requires a decisive recovery of $2.36

Volume profile:

• Total session volume 157.9 million (+46%) confirms the institutional quality distribution

• Fault sequence displayed 254% hourly volume peak, typical of liquidation-related movements

• No significant recovery volume appeared during post-crash consolidation

Chart structure:

• Descending triangle support failed decisively, killing the previous reversal pattern.

• New lower range forming between $2.29 to $2.33

• The breakdown aligns with the medium-term downtrend of broader crypto indices.

Dynamic indicators:

• Oversold signals emerge during the day, but no confirmation of a trend reversal

• Breakdown occurred below key EMAs; 50D/200D crossover continues to decline

What traders should watch out for

XRP now stands at a crucial inflection point:

• Holding $2.29 is essential – failure exposes a rapid passage to $2.00 to $2.20 demand area

• Any recovery must first recover $2.36 before the bulls regain technical control

• ETF inflows will act as the next volatility catalyst; Early XRPC volume during the market open will indicate whether institutions are treating the listing as an accumulation opportunity or a liquidity event.

• Chain flow around the 110.5 million XRP whale transfers remain a wild card – FX flows would confirm further downside risk

• Sentiment remains fragile among the majors; Beta-sensitive assets like XRP will react disproportionately to broader market weakness.