XRP breaks a critical technical level amid heavy selling pressure, finding temporary support at $2.05 before stabilizing above $2.11 in a volatile session.

News context

• No major fundamental catalyst accompanied the decline, although broader crypto markets weakened.

• Sentiment remains fragile as Bitcoin’s ‘Death Cross’ reinforces risk aversion conditions among majors

• Institutional flows turned defensive, with XRP underperforming CD5 despite recent ETF launches.

• Analysts warn that support failures between altcoins can signal early-stage distribution cycles.

Price Action Summary

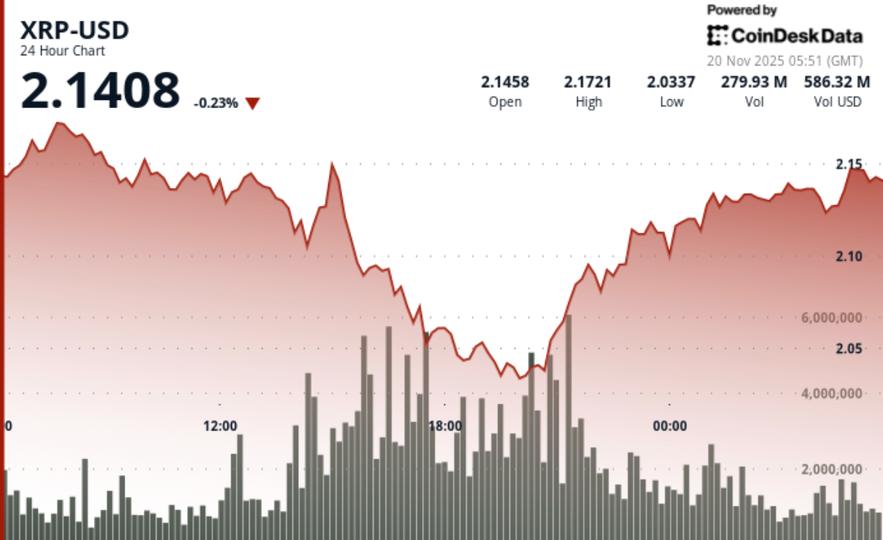

• XRP fell 3.6% from $2.21 → $2.13breaking the critical support at $2.15

• Daily trading range widening 7.8% with the price testing the $2.04 to $2.05 demand zone

• Volume increased to 177.9M (+76% above average) during the fault sequence

• Recovery attempts pushed the price back above $2.11but tracking faded due to volume drop

Technical analysis

XRP suffered another technical breakdown on Tuesday, sliding 3.6% to $2.13 as institutional selling intensified below the key support level of $2.15. The decline took place within a volatile $0.17 range, with volume increasing 76% above 24-hour norms to 177.9 million tokens, confirming the participation of large orders during the structural failure.

Sellers exceeded bids in evening trading, forcing XRP into the $2.04-$2.05 demand pocket where buyers finally emerged. The rebound pushed the token back to between $2.11 and $2.12, but the rally lacked depth as volume evaporated by the close of the session. The market structure now reflects a clear low-high and low-low formation, consistent with persistent bearish momentum.

Despite stories of ETF-related inflows, XRP has underperformed broader crypto benchmarks – a sign that structural supply is outweighing fundamental optimism in the short term.

What traders should watch out for

The rejection to $2.21 and subsequent collapse below $2.15 highlights the market’s sensitivity to points of technical failure. The $2.05 support reaction suggests that oversold conditions have temporarily halted the decline, but the rebound does not have enough volume to confirm a lasting change in momentum.

Traders are now watching if XRP can recover $2.15which would neutralize the immediate bearish bias. Failing to do so keeps downside targets open, especially as charts on shorter time frames show bid clusters forming between $2.13 and $2.15 with no signs of aggressive bid absorption.

The dynamic remains under pressure from macroeconomic correlations. Bitcoin’s death cross, weakening liquidity, and risk-aversion flows among altcoins suggest volatility may persist, and XRP – typically a high-beta asset – remains exposed to sector-wide liquidation scenarios.