Major support at $0.155 collapsed under heavy selling pressure, but improving FX flows and accelerating whale accumulation suggest downside exhaustion may be near.

News context

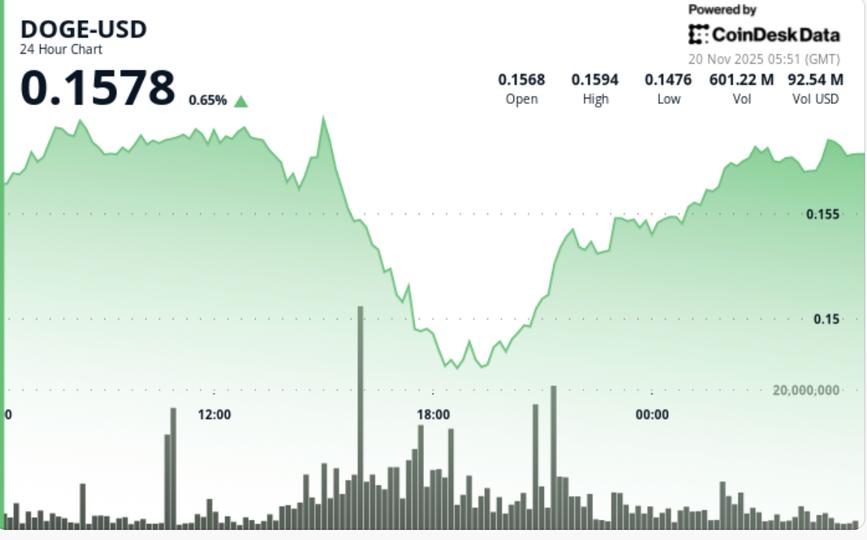

• DOGE rose from $0.160 to $0.149, breaking major support at $0.155.

• Net foreign exchange inflows turned positive for the first time in months – a historic precursor to a resumption of relief.

• Analysts point to a potential window for DOGE ETF approval under Section 8(a) in the next seven days.

• Whale accumulation totals 4.72 billion DOGE ($770 million) over two weeks despite price drop

• The broader crypto market remains in extreme fear, with sentiment at its lowest since April

Crypto markets continue to deteriorate as Bitcoin’s “Death Cross” and risk-averse conditions pressure altcoins. However, the dynamics of DOGE exchange flows have turned positive – a structural change that historically appears near market lows. Analyst Ali Martinez notes that similar inflection points preceded reversible capitulation phases in previous cycles.

Price Action Summary

Dogecoin plunged 7.42% during the 24-hour session, crashing from $0.160 to $0.149 in a breakout that shattered the critical $0.155 support that anchored the previous consolidation range. Volume jumped 18.39% above weekly averages, confirming institutional participation rather than retail panic.

The selloff marked a clear violation of the 0.5 Fibonacci retracement of the previous bull cycle and pushed the price directly into the lower boundary of DOGE’s one-year descending triangle. The decline extended across several intraday lows before stabilizing between $0.149 and $0.151. Oversold conditions emerged as the RSI created a bullish divergence from new price lows, while the MACD’s short-lived crossovers hinted at the exhaustion of bearish momentum.

Technical analysis

Dogecoin now sits at a high-stakes intersection between breakdown confirmation and reversal potential. The collapse below $0.155 completes the resolution of the descending triangle, traditionally projecting continuation towards the $0.145-$0.140 zone. However, countersignals are multiplying.

Whale accumulation intensified significantly, with high-value wallets absorbing over 4.7 billion DOGE as prices fell – a sign of strong hands intervening against weak retail flows. Simultaneously, net foreign exchange inflows turned positive for the first time in months, a structural change that previously preceded trade troughs.

Momentum indicators support this divergence: the RSI continues to advance even as prices make lower lows, and bearish signals from the MACD fade quickly. This creates a mixed but increasingly interesting setup where technical breakdown collides with early reversal signals anchored in on-chain behavior.

DOGE price will likely remain compressed between the $0.149 support and $0.158 resistance until ETF catalysts or macroeconomic sentiment provide a decisive boost.

What traders should watch out for

Traders face a binary pattern shaped by both regulatory catalysts and technical shifts:

• Monday deadline for Section 8(a) DOGE ETF – surprise approval could trigger immediate reassessment

• Recovery of $0.155 – essential to undo the breakdown and reopen the path between $0.162 and $0.165.

• Failure at $0.150: Exposes to a rapid continuation towards the demand zones of $0.115 to $0.085.

• Direction of exchange flows: net inflows that are always positive would reinforce the reversal thesis.

• Macroeconomic sentiment: Extreme fear around BTC and altcoins can produce sharp relief moves, but also increases the risk of a breakdown.

The risk/reward setup becomes very favorable for directional traders as DOGE approaches the top of a multi-year structure while ETF catalysts converge with on-chain accumulation dynamics.