Calls for liquidation on the sidelines are growing louder for Strategy (MSTR) as bitcoin falls and the company’s common stock has plunged nearly 70% from last year’s high, calling into question – for some – the company’s ability to continue meeting its obligations.

Throughout 2025, Strategy relied on perpetual preferred stock as its primary funding vehicle for bitcoin purchases, while primarily using at-the-market (ATM) common stock issuance, primarily to cover its preferred dividend obligations.

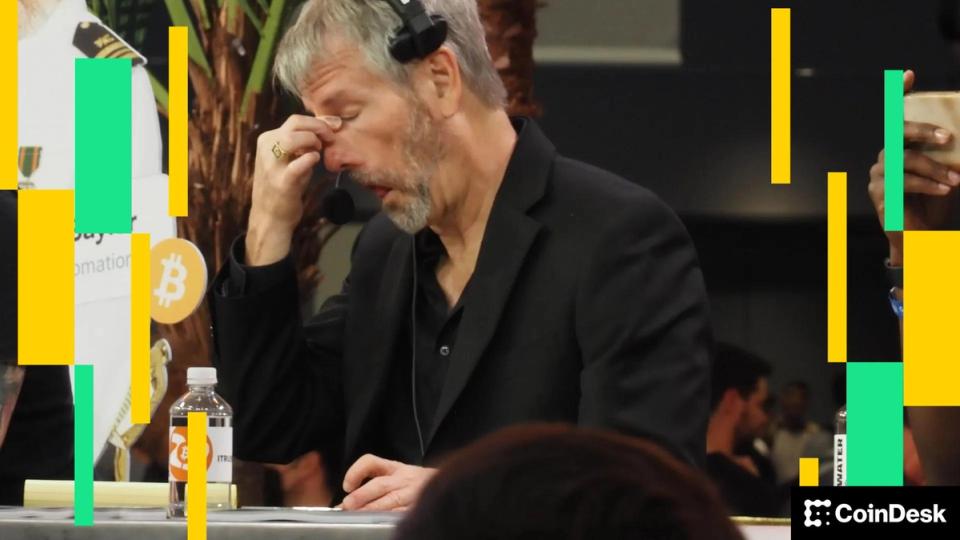

Led by Executive Chairman Michael Saylor, the company issued four U.S.-listed preferred series during the year: Strike (STRK) pays a fixed dividend of 8% and is convertible into common stock at $1,000 per share. Strife (STRF) carries a non-cumulative fixed dividend of 10% and is ranked as the number one preferred stock. also pays 10% but on cumulative conditions and occupies a junior place in the structure. Stretch (STRC), the newest series, debuted in August at $90 with a fixed cumulative dividend of 10.5% and is now trading just above its offering price.

As of November 21, STRK was trading at nearly $73, a current yield of 11.1%, down 10% since issuance. STRD was the worst performer, falling to around $66 for a 15.2% return and a 22% total return loss. STRF is the only series still above the issue, trading around $94 and making a gain of around 11%, reflecting its prime position.

Almost back to break even

Bitcoin’s plunge over the past few weeks has market participants focusing on the level around $74,400 at which Strategy – after more than five years of accumulation – would actually be in the red on its Bitcoin holdings.

While this is certainly an important level for talking points, a drop below $74,400 certainly does not mean that the company would face a margin call or that it would have to engage in forced sales of any part of its BTC stack.

The closest structural pressure point will be in almost two years, on September 15, 2027, when holders of the $1 billion 0.625% convertible senior notes receive their first put option.

The tickets were priced at $130.85 when MSTR was trading and their conversion price was $183.19. With the stock now at around $168, holders are unlikely to convert and would likely seek a cash redemption, which could force Strategy to raise or liquidate assets unless the stock price rises significantly before 2027.

Multiple levers remain

Even if the valuation premium of MSTR stocks over bitcoin holdings (the mNAV) further collapses and perhaps even declines, Strategy still has a clear path to cover the annual preferred dividend bill.

The company can continue to issue common stock through ATM offerings, or sell small tranches of its Bitcoin treasury, or even pay in-kind dividends with the newly issued shares.

This doesn’t mean everything is fine. While preferred dividends are not in immediate jeopardy, using any of the above options would surely further damage investor confidence in the strategy, likely ending – at least temporarily – any effort to raise additional capital to purchase more bitcoin.