Bitcoin staking project Babylon has partnered with the largest decentralized lending protocol Aave, allowing BTC to be used directly as collateral without packaging or centralized custody.

Beyond lending, Babylon is also preparing to expand its vault design into decentralized finance insurance (DeFi), allowing BTC to serve as collateral for coverage against protocol hacks. BTC would be deposited into insurance pools and produce a yield if no payments were made, while providing liquidity for claims in the event of a hack.

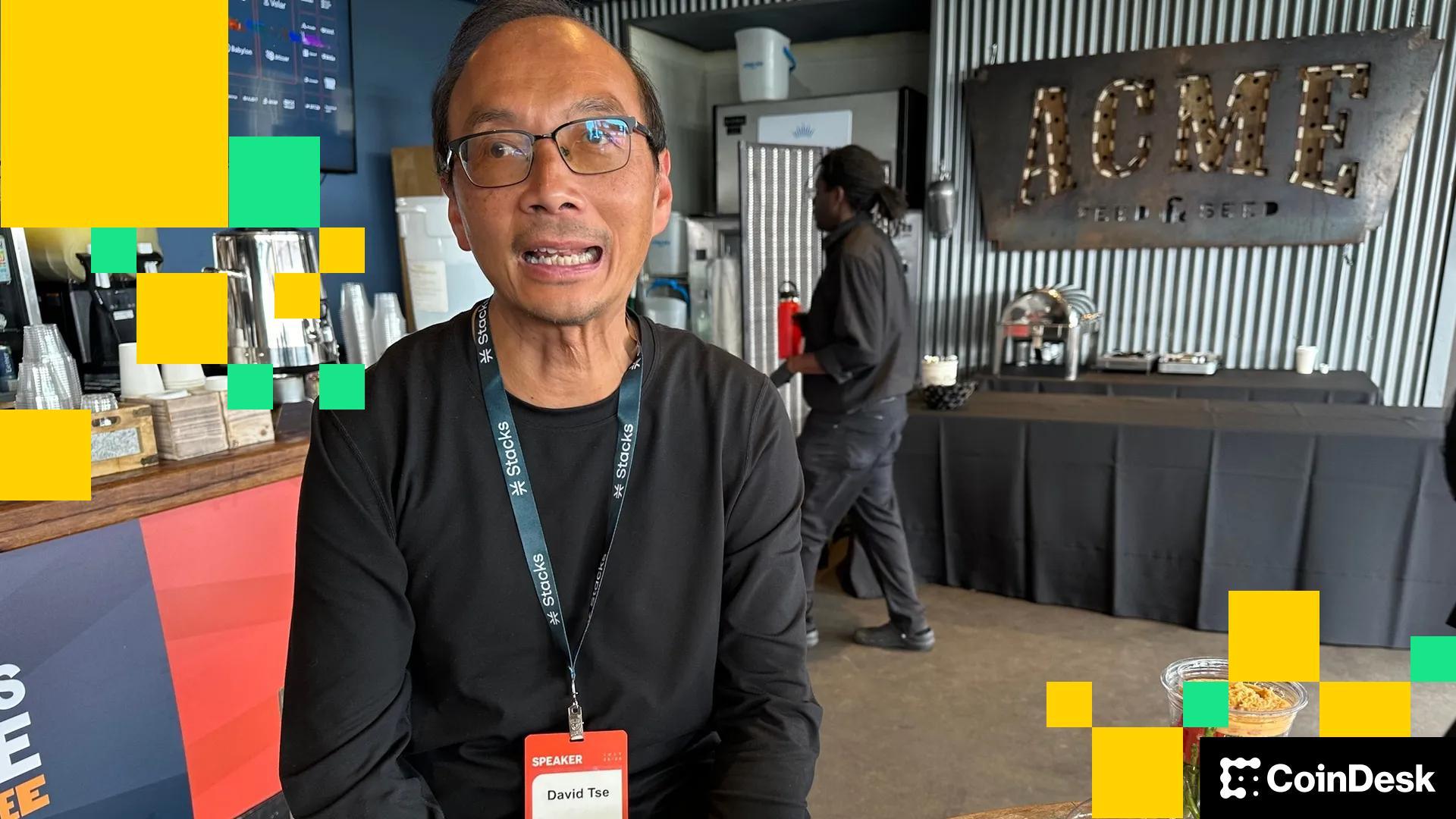

This initiative is under development and is expected to be announced by January 2026, Babylon co-founder David Tse told CoinDesk in an interview.

Babylon and Aave team up to reshape BTC lending

Although BTC-backed lending has become a multi-billion dollar industry, much of this business relies on custodial models, in which users receive a tokenized version of Bitcoin. Even the largest of these – Wrapped Bitcoin (WBTC) – represents well less than 1% of bitcoin’s total market capitalization, a key limitation for DeFi protocols hungry for greater liquidity.

Unlocking native BTC, as opposed to a wrapped version of Bitcoin, could reshape lending markets, Tse told CoinDesk.

“Even 5% of the Bitcoin supply going into lending protocols would be huge compared to what is available today,” Tse said.

Babylon’s own Bitcoin staking product secures over 56,000 BTC ($5.15 billion), suggesting healthy demand for productive BTC use cases. Users, Tse said, “want to hold Bitcoin while making money,” and lending is the most natural place to start.

The project is partnering with Aave to combine the former’s trustless vaults – which allow native bitcoin to be used elsewhere in the blockchain ecosystem – and the latter’s “hub and spoke” architecture. Babylon will build a dedicated Bitcoin-backed “spoke” within Aave’s lending “hub,” allowing users to deposit real Bitcoin onto its base chain while borrowing stablecoins and other assets on Aave’s marketplaces.

Testing is expected to begin in early 2026, with a view to unveiling the product around April.