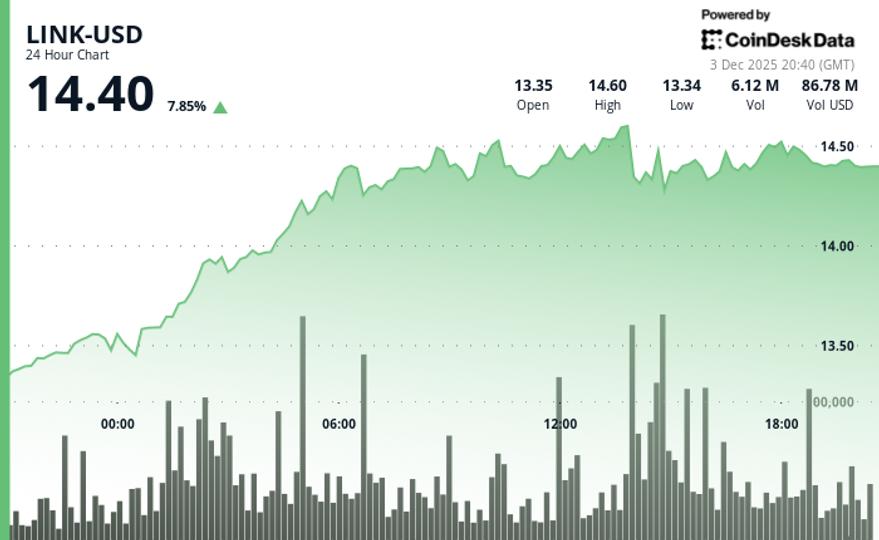

Chainlink’s native token LINK rose 7% in the past 24 hours on Wednesday, outpacing the broader crypto market as traders reacted to the debut of the first U.S.-listed spot Chainlink ETF.

The Grayscale Chainlink Trust ETF (GLNK), converted from a closed-end fund and traded on NYSE Arca, generated $37 million in net inflows on its first day on Tuesday, according to SoSoValue data. The launch marks a significant milestone in the institutional adoption of Chainlink, providing traditional investors with direct exposure to LINK through brokerage accounts.

Trading activity around LINK increased sharply, with trading volume surging 183% above the 24-hour average, peaking at 6.71 million tokens traded as of 2:00 p.m. UTC as LINK briefly reached $14.63 before retreating, noted market analysis tool CoinDesk Research.

Despite the rejection at session highs, the token maintained an ascending trendline from its base of $13.35, recording higher consecutive lows throughout the day and maintaining a bullish structure, the tool suggests.

LINK has outperformed most of the top 20 cryptocurrencies, helped by both the ETF catalyst and a broader rotation into tokens with clear utility narratives. The CoinDesk 5 Index also rose 3.3% on the day, although LINK’s gains outpaced the benchmark by more than 4 percentage points.

Key technical levels to watch:

- Support/Resistance: Support holds at $14.28 with psychological support at $14.40; resistance at $14.63.

- Volume analysis: A 183% volume increase at the session high signals institutional participation and resistance testing.

- Chart templates: A consolidation between $14.395 and $14.445 could form a launching pad for a further breakout.

- Targets and risk/reward: Short-term target at $14.63, with a wider upside possible if buyers hold above $14.28.

Disclaimer: Parts of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.