Strategy’s perpetual senior preferred stock (MSTR), STRF, has increasingly established itself as the company’s best-performing credit instrument since its launch in March.

Trading at $110, STRF is up 36% since issuance and has rebounded 20% from its November 21 low of $92. This date also marked Bitcoin’s local low near $80,000, highlighting the strong correlation between STRF and Bitcoin.

STRF occupies the top level of Strategy’s preferred structure. It pays a fixed annual cash dividend of 10% and has governance rights as well as mark-ups based on penalties for non-payment. Although its premium price lowers the effective yield to around 9.03%, demand remains strong due to the security’s senior protections and long-duration credit profile.

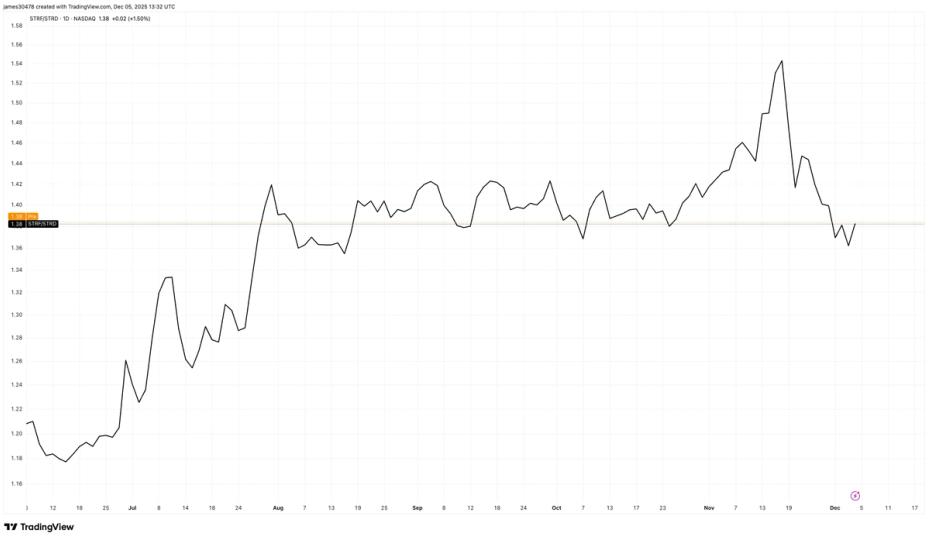

In late October, Executive Chairman Michael Saylor highlighted a growing credit gap between STRF and junior STRD. The spread measures the additional return investors demand for holding riskier junior securities, which now stands at 12.5%. At the November 21 low, this gap widened to an all-time high of 1.5 as investors gathered in senior exposure, with STRD trading as low as $65. The gap has since normalized around 1.3.

The divergence is now visible in Strategy’s favorite sequel. STRC has experienced four dividend rate increases to support investor interest.

Strategy shares also rebounded from a low of $155 on Dec. 1 to around $185, reflecting improved confidence in both the company’s balance sheet and the bitcoin market since announcing a $1.44 billion cash reserve for preferred dividend payments.