As cryptocurrency fan Donald Trump prepares to take the reins of government, the US Consumer Financial Protection Bureau has outlined new regulations that would significantly impact stablecoin issuers and wallet providers, although the future of the proposal remains uncertain.

On Friday, the CFPB took the first procedural step to open for public comment a proposal that would establish a framework for applying the Electronic Funds Transfer Act to virtual wallets and stablecoins – digital tokens tied to the value of a stable asset, usually in the United States. dollar. While this has heavy implications for how US stablecoin companies and crypto wallet providers would do business, we are only at an early stage as Trump is about to arrive at the White House with the power to appoint a new head of the CFPB.

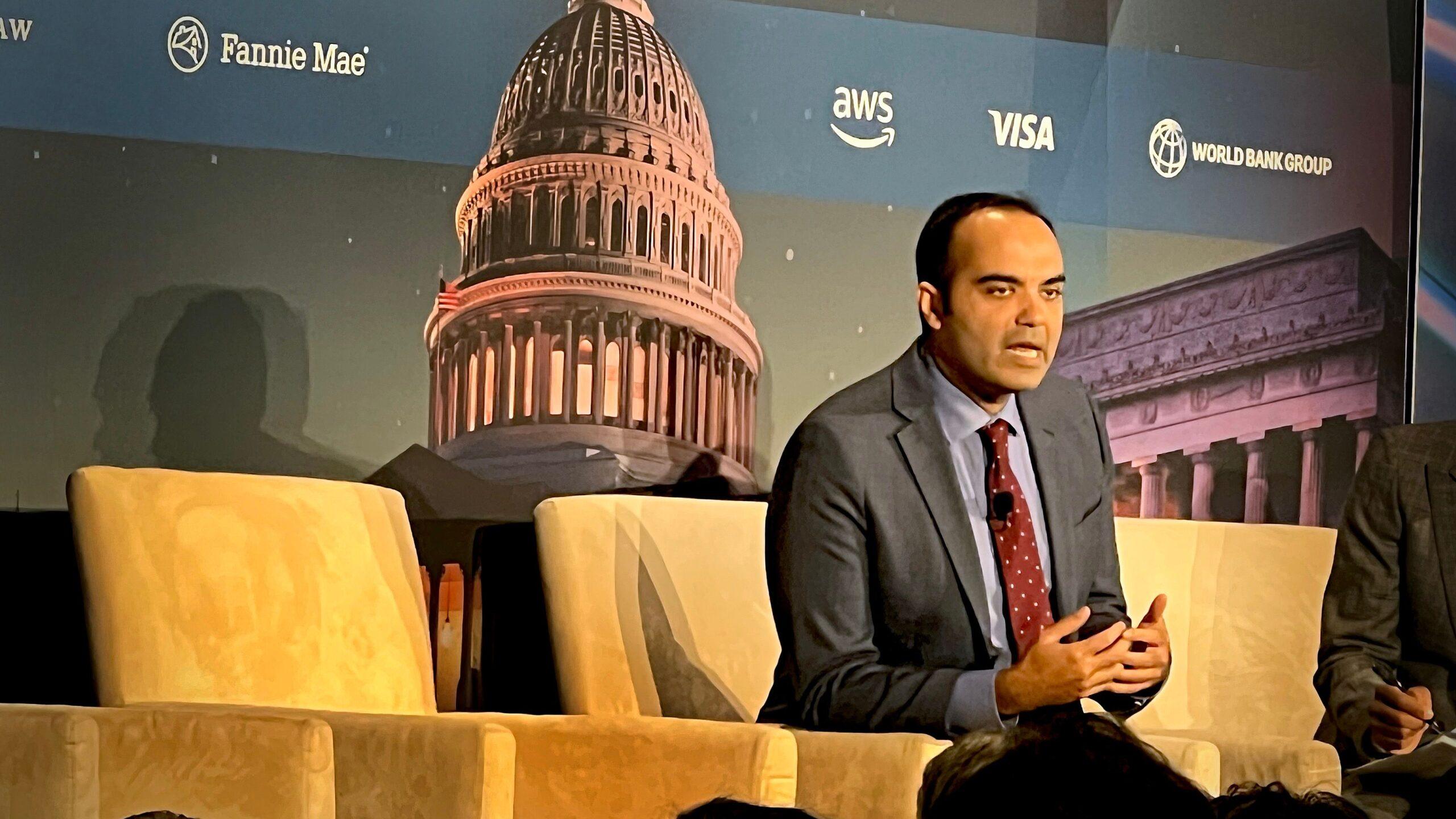

Unlike other agency heads, such as those at the Securities and Exchange Commission and the Commodity Futures Trading Commission, it appears unlikely that CFPB Director Rohit Chopra will resign voluntarily. Since the agency’s creation after the 2008 global financial crisis, its leaders have often adopted a more aggressive posture than other regulators, and Republican lawmakers have actively sought to weaken the CFPB’s powers.

In 2020, the Supreme Court confirmed that the president can fire and replace the director at will – a power Trump is expected to exercise.

This last-minute regulatory effort will have to survive the arrival of a Trump-appointed leader before it can be finalized and implemented. Even if it were a final rule, the Republican-led Congress would have a chance to erase it through its authority under the Congressional Review Act.

Should it survive, the regulation as proposed – and now open to a public comment period – considers stablecoins as a payment mechanism. The reference to “funds” in existing law should include stablecoins, the proposal suggests, and it could arguably also include other, more volatile cryptocurrencies such as bitcoin. “Under this interpretation, the term ‘funds’ would include stablecoins, as well as any other similarly situated fungible asset that functions either as a medium of exchange or as a means of payment for goods or services,” the proposal states.

He further stated that the scope of the law on financial “accounts” should include “virtual currency wallets that can be used to purchase goods and services or make person-to-person transfers”, particularly if they are used for retail transactions and not purchases. and the sale of securities or commodities.

Institutions that provide such accounts would be subject to regulatory requirements to disclose the information to consumers and provide protections against unauthorized transactions and the ability to reverse inappropriate transfers. These government requirements could run counter to the way crypto operations are often set up – such as in decentralized finance (DeFi) – as person-to-person platforms without outside interference, or with technology wallet provided so that users can manage them themselves.

Consumer advocacy group Better Markets applauded the agency’s proposal Friday.

“The CFPB’s proposal today extends EFTA protections to non-bank digital payment mechanisms,” Dennis Kelleher, the group’s president, said in a statement. “This would not only protect consumers, but also level the playing field between digital payment mechanisms, whether it is a bank account or a savings account or another asset account consumer products such as those used by crypto and video game companies.”

Jack Solowey of the Cato Institute, a policy analyst at the conservative think tank, countered in an article on the social media site decentralized and self-hosted wallets.

Bill Hughes, director of global regulatory issues at Consensys, the Ethereum development company, also spoke out against X’s development, suggesting: “Add this to the list of ‘law by decree’ issues that need to be addressed resolved.”