XRP posts respectable gains but continues to track the broader rise in digital assets, with below-average volume raising questions about the strength behind the move as bitcoin climbed above $94,000 and large-scale liquidations reshuffle positioning.

News context

- Bitcoin’s sudden surge above $94,000 triggered a broad rebound across major crypto assets, with almost all large-cap tokens seeing immediate upward volatility.

- This decision violently unraveled bearish positions on derivatives markets: 107,333 traders were liquidated in 24 hours, totaling $387.5 million in forced exits, including a single long liquidation of $23.98 million BTC on HTX.

- Despite the high-energy macroeconomic backdrop, XRP’s reaction has been muted compared to its peers. The token underperformed the CD5 index by 1.55%, implying a sector rotation away from XRP during the risk appetite period.

- Institutional flows also did not accelerate significantly, with 24-hour volume falling 5.88% below its 7-day average despite positive price action.

- This divergence – strong macroeconomic rally, weak relative performance – paves the way for more nuanced technical outlooks in the sessions to come.

Technical analysis

- XRP maintains a constructive intraday structure with higher highs and higher lows, but the underlying momentum remains inconsistent compared to other majors.

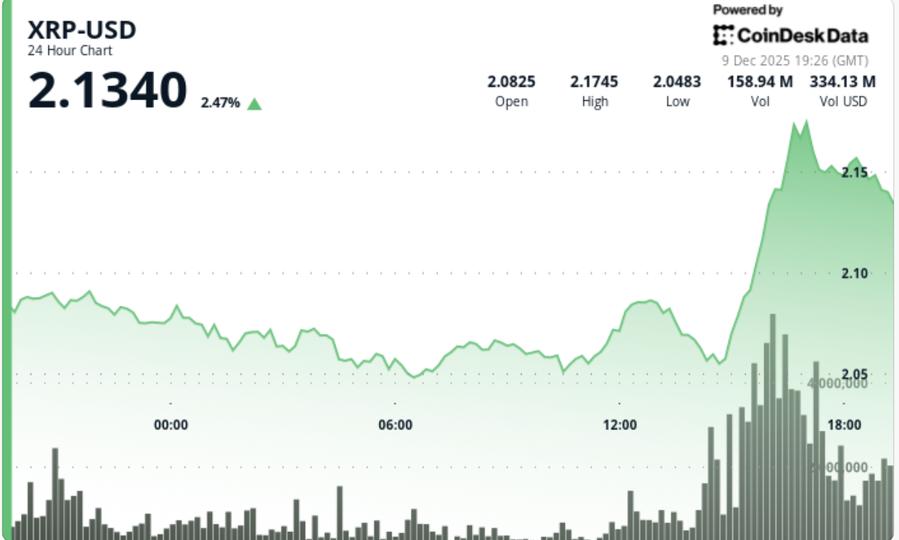

- Support continues to form at $2.05, where several intraday tests performed convincingly. The rally towards $2.17 established a new local resistance level, and although the structure remains bullish, the lack of sustained volume expansion limits confirmation.

- Momentum indicators on shorter time frames show a slowdown after the breakout attempt: the rise at 3:00 p.m. produced a strong volume rejection at resistance, followed by a gradual pullback into the $2.15-$2.16 range.

- This behavior reflects profit-taking rather than a trend reversal, but it also confirms that bulls lack full control until participation widens.

- As Bitcoin drags major currencies higher, XRP’s relative underperformance becomes a technical signal in itself, often a precursor to either a delayed bullish catch-up or deeper consolidation if macroeconomic momentum fades.

Price Action Summary

- XRP rose from $2.08 to $2.15, generating a gain of 4.71% in a trading range of $0.09 (4.3%).

- The breakout towards $2.17 occurred following a strong volume burst of 128.7 million tokens, 147% above the 24-hour moving average, but post-rally participation fell rapidly, confirming the short-term hesitancy of large traders.

- The underperformance relative to the broader market reflects the rotation of capital into higher beta assets during Bitcoin-driven surges, leaving XRP rising but without the explosive pace displayed by its peers.

What Traders Should Know

- XRP is stuck between a constructive local structure and weak relative strength. The recovery remains intact as long as $2.05 holds, but bulls need to recover and close above $2.17 with expanding volume to confirm momentum alignment with broader market flows.

- If Bitcoin maintains levels above $94,000, XRP historically lags before accelerating its delayed catch-up moves, making the next 24-48 hours critical for confirmation.

- Monitor:

• volume acceleration on any break above $2.17

• failure to expand participation, which could trap prices in a consolidation range of $2.05 to $2.17.

• broader market liquidation trends, which could redistribute capital to lagging majors like XRP - If $2.05 fails, the next significant support lies between $1.98 and $2.00, where ETF-led demand has recently provided stabilizing supply.