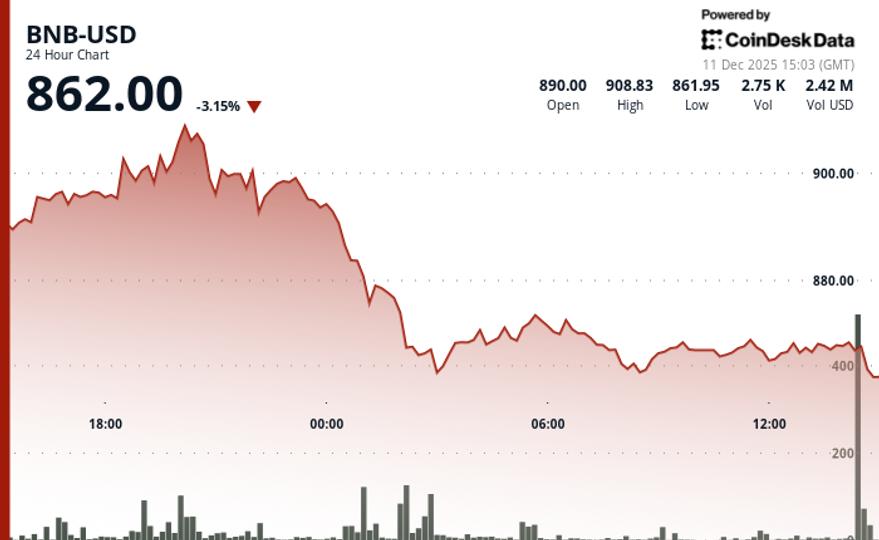

The price of BNB, the native token of the BNB chain, fell 3% over the past 24 hours to $865 as traders digested the Federal Reserve’s rate cut on Wednesday.

BNB fell along with the broader CoinDesk 20 Index (CD20), which is down 3.4% over the same period.

The token reached $908.83 on Wednesday before reversing sharply. Selling pressure increased as BNB broke $870, a key support zone that had held in recent weeks, according to CoinDesk Research’s technical analysis data model. The distribution was supported by volume, with commercial activity increasing.

BNB also fell below its 30-day moving average and the 23.6% Fibonacci retracement level at $874, strengthening the bearish pattern. These indicators often signal to traders that a short-term uptrend may be ending.

While BNB found some footing near $861.95, several attempts to rebound towards $870 were met with resistance. The token is now trading in a tight range, with buyers defending the $864-$867 zone and sellers capping gains near $868.50.

For now, traders appear cautious. A recovery above $874 could shift the momentum, but as network activity is about to grind to a halt, most are waiting for the upgrade to complete before taking new positions.

A deeper decline could push BNB towards $839, the next technical support based on Fibonacci levels.

Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.