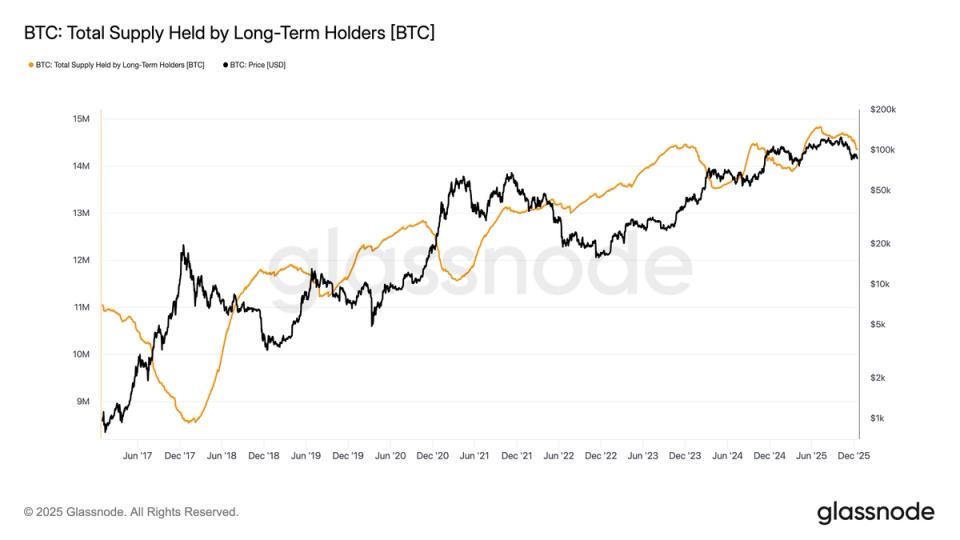

Bitcoin long-term holder (LTH), supply fell to an eight-month low of 14,342,207 BTC, a level last seen in May, which coincided with bitcoin falling nearly 40% from its all-time high in October.

Glassnode defines a long-term holder as an entity that has held bitcoin for at least 155 days, placing the current cohort limit around mid-July, so any purchaser at that time who held it would be classified as LTH.

This drop marks the third distinct wave of LTH distribution in the current cycle since early 2023.

The first wave occurred between late 2023 and early 2024, after the launch of spot bitcoin ETFs in the United States, when LTHs sold off heavily as bitcoin rose from around $25,000 to a high near $73,000 in March 2024.

The second wave appeared later in the year, when bitcoin hit $100,000, driven by optimism surrounding President Trump’s election victory. The market is currently experiencing a third iteration of LTH selling, with bitcoin remaining above $100,000 for much of the year.

Why is this cycle different?

This behavior contrasts with previous bull markets of 2013, 2017, and 2021, where LTH supply generally followed a single boom-and-bust pattern, bottoming out near euphoric cycle highs before gradually recovering.

Instead, this cycle has seen repeated distribution waves without a clear breakout, a dynamic highlighted by Alec, co-founder of Checkonchain, who noted that Bitcoin LTH spending this cycle is unlike anything seen in recent history, with the market absorbing a third wave of selling remarkably well.

The LTH distribution remains one of the largest sources of selling pressure on Bitcoin and was a key contributor to the nearly 40% correction from October’s all-time high.