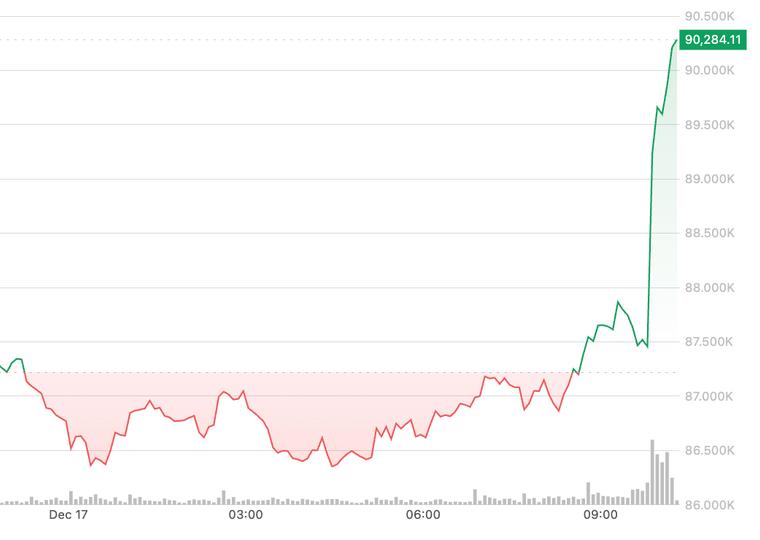

Crypto prices saw a rare surge just after US stocks opened on Wednesday, taking on bitcoin back above the $90,000 level for the first time since last weekend.

Possible bullish catalysts include continued strong gains in metals prices, with silver gaining around 5% to hit a new record high above $66 an ounce. Gold and copper were also up more than 1%.

Now leading the markets in predicting who will become the next Federal Reserve chairman, current Fed Governor Chris Waller made conciliatory remarks, suggesting that the neutral federal funds rate was 50 to 100 basis points below the level. He added that the United States is now close to zero job growth and that he does not expect inflation to rebound.

According to Coinglass data, open interest increased from 669,000 BTC to 665,000 BTC while the price increased. This suggests that shorts are covering rather than new leverage entering the market. This move resembles a deleveraging rally, driven by closing short positions instead of accumulating new long positions.

In total, bitcoin is now ahead by around 3% over the past 24 hours. Bitcoin bulls could be forgiven for any excitement over a move that isn’t that big. However, muscle memory over the past few weeks has crypto fans bracing for significant declines during the US market day, particularly at the open. Any lasting change in this trend would surely be notable.

The averages of major US stock markets were little changed in early trading and the 10-year US Treasury yield was two basis points lower at 4.15%.