In 2025, the sound money, or debasement trade, was won decisively by metals rather than bitcoin. Gold has had one of its best years on record, up 65%, while bitcoin is down 7% so far.

Through August, the two assets had similar returns, both up around 30%. From that point on, gold surged while bitcoin fell sharply.

This divergence reinforced that gold won the devaluation trade narrative, leaving bitcoin firmly behind.

Bitcoin remains in recovery mode after a 36% correction from its October all-time high, hovering in the $80,000 range.

Despite low prices, capital flows tell a different story.

Bitwise CEO Bradley Duke highlighted that Bitcoin exchange-traded product (ETP) flows have surpassed gold ETP flows in 2025, despite gold’s blockbuster year.

The debut of spot bitcoin ETFs in the United States in January 2024 marked the first year of institutional adoption, while the second year saw continued strong participation even if prices did not follow.

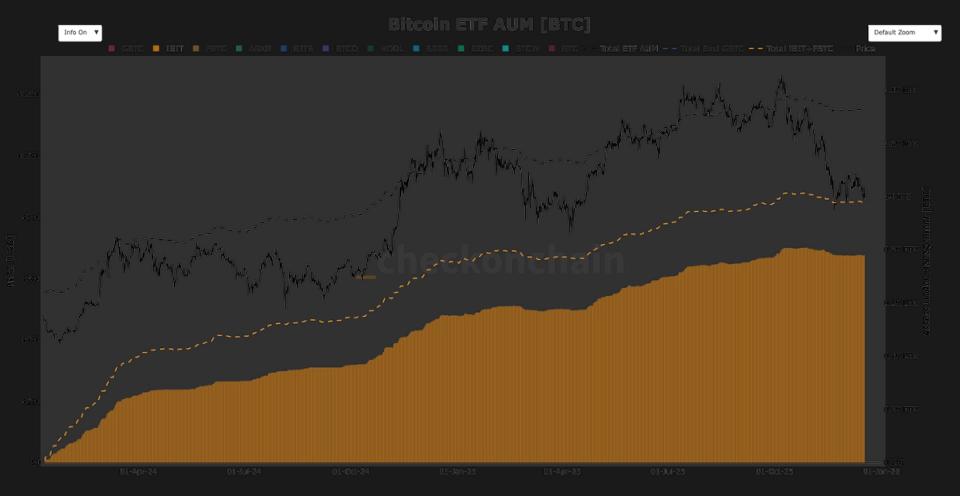

The most notable point of this current bitcoin correction is the resilience of ETF investors. Despite a 36% price decline, total assets under management (AUM) for Bitcoin ETFs declined by less than 4%.

Checkonchain data shows that US ETFs held 1.37 million BTC at the October peak and still held around 1.32 million on December 19. This suggests that most of the selling did not come from ETF holders. BlackRock’s iShares Bitcoin Trust (IBIT) has increased its dominance during this correction, now holding just under 60% market share with approximately 780,000 BTC under management.

It is clear that the Bitcoin correction was not driven by ETF outflows.