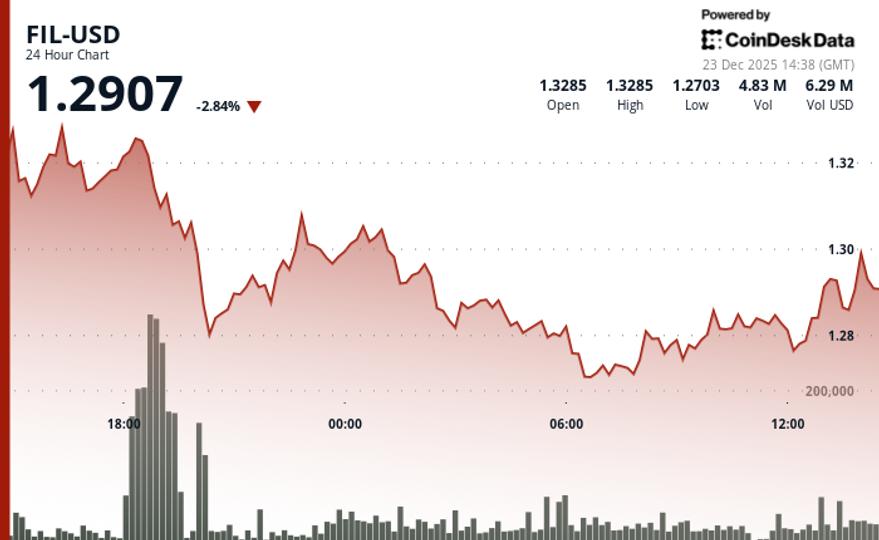

Filecoin fell 2.2% over 24 hours from $1.32 to $1.29 as technical sellers dominated the price action.

The decentralized storage token has established a clear bearish channel pattern with successive lower highs confirming downward momentum in the 5 cent trading range, according to CoinDesk Research’s technical analysis model.

The model showed that volume activity tells the real story. Trading exploded last night to 7.59 million tokens, 180% above the 24-hour average.

This rise coincided with selling at the $1.33 resistance level, marking a clear institutional distribution, according to the model.

In the absence of fundamental catalysts driving price action, technical levels have become the main battleground. The rapid recovery from the $1.28 support demonstrates that institutional buyers remain active despite the prevailing bearish channel structure, according to the model.

FIL’s weakness came amid a decline in broader crypto markets. The CoinDesk 20 Index was down 3.1% at press time.

Technical analysis:

- Critical Support Holds at $1.28 After Intraday Liquidation Event

- Key resistance barrier at $1.33 where institutional selling has emerged

- Volume peak at 7.59 million tokens confirms major distribution activity

- Descending channel pattern shows successive lower highs confirming downtrend

- V-shaped reversal from $1.28 proves institutional appetite for accumulation

- The immediate upside target between $1.31 and $1.32 offers 3.5% upside potential.

- A move below $1.28 sets the stage for an extension to $1.26

- Current risk/reward ratio favors long positioning with stops below $1.2800

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.