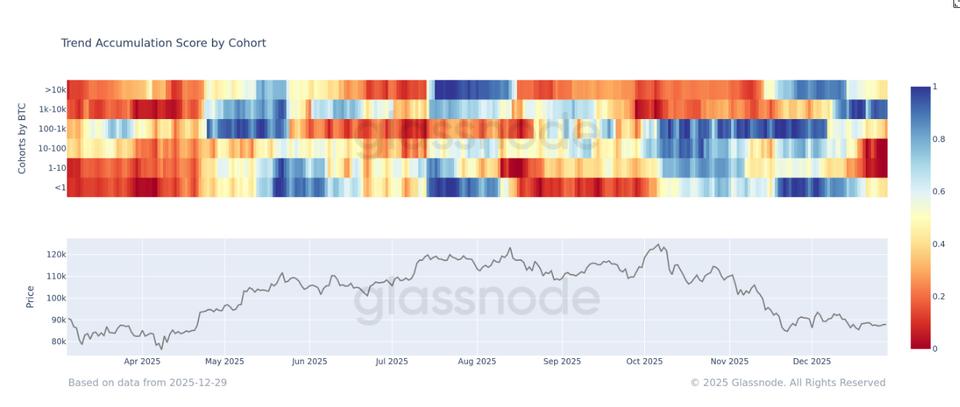

Bitcoin whales, or holders of at least 1,000 BTC, have been the dominant buyers since the price of the largest cryptocurrency bottomed near $80,000 in late November, according to Glassnode data. They remain the most powerful accumulators, with bitcoin trading just below $90,000.

According to Glassnode data, the 1,000-10,000 BTC cohort is the only group showing sustained accumulation, with an accumulation trend score close to 1.

The metric breaks down the buying and selling behavior of wallet cohorts, measuring both the size of entities and the net amount of bitcoin they acquired in the last 15 days. A score closer to 1 indicates accumulation, while a score closer to 0 signals distribution.

The data suggests that large holders have been accumulating bitcoin in the $80,000 range, a price level that bitcoin has not traded for an extended period of time compared to other price categories.

This behavior contrasts sharply with that of smallholders, all of whom exhibit varying degrees of distribution.

Given that the Crypto Fear and Greed Index has remained in the “fear” or “extreme fear” category for the past 30 days or so, this selling pressure from smaller entities likely reflects capitulation.

Meanwhile, the cohort of more than 10,000 BTC whales were buying aggressively when Bitcoin was trading near $80,000 in late November, although they have started to slow down in recent weeks. Yet as a cohort, they are not yet selling, which was the dominant behavior when the BTC price surpassed $100,000 around the middle of the year.