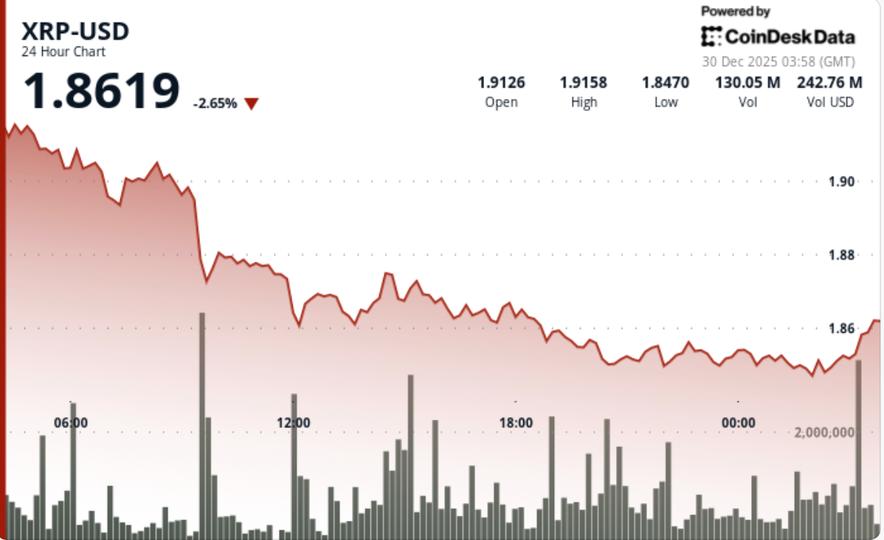

XRP slipped to $1.85 after breaking through the $1.87 support zone, with stronger exchange flows pointing to further distribution, just as bitcoin’s rally was losing momentum and risk appetite remained cautious.

News context

Institutional interest in XRP remains structurally favorable via ETFs, but short-term flows tell a different story. On-chain data shows a sharp increase in XRP deposits on major exchanges in recent weeks, suggesting that holders are increasingly positioning themselves to sell on rallies rather than accumulate.

Daily exchange inflows have ranged between approximately 35 million and 116 million XRP since mid-December, a notable change from previous periods of relative balance. Such behavior generally reflects profit-taking or defensive repositioning rather than speculative accumulation.

The move comes as Bitcoin’s attempts to regain bullish momentum have struggled to sustain during U.S. trading hours, keeping large-cap cryptocurrencies locked in a risk-management band. With ether also failing to generate sustained momentum, secondary majors like XRP have been more exposed to supply-driven moves.

Technical analysis

XRP rose from $1.89 to $1.85, decisively breaking the $1.87 support zone that had held during the recent consolidation. Sales accelerated during the most active window, with volume reaching around 68 million XRP – around 77% above the 24-hour average – confirming that this move was not a drift from low liquidity.

On shorter time frames, price action formed a tentative double bottom between $1.846 and $1.848, but rebounds repeatedly stalled near $1.85, turning that level into short-term resistance rather than support. The broader structure remains a descending channel, and failed rebound attempts suggest sellers are still active with minor strength.

Momentum indicators are starting to show oversold conditions, but the price has yet to find significant resistance. In the meantime, the technical bias remains defensive rather than ready for a reversal.

Price Action Summary

- XRP rose from $1.89 to $1.85 over 24 hours, surpassing the $1.87 support

- Sales peaked during the outage with volume ~77% above average

- The price briefly stabilized near $1.846 but failed to cleanly regain $1.85.

- Rebounds were capped, reinforcing a lower-high structure

What Traders Need to Know

This is a classic provisioning versus support setup.

Exchange feeds suggest that more XRP is available for sale, which partly explains why rallies continue to stall even as long-term ETF demand remains intact in the background.

The levels are clear:

- If $1.85 fails, the decline will open towards $1.84 and then towards the $1.77-$1.80 demand zone, which buyers have already stepped into.

- If XRP can reclaim $1.87, and importantly close above $1.90, it would signal that selling pressure is easing and refocus attention towards $1.95 – $2.00.

For now, the tape reads like a consolidation with distribution overload. ETF flows can cushion a sharp decline, but unless Bitcoin regains momentum, XRP will likely remain vulnerable to further investigation of support rather than a clear recovery.