XRP soared as high as $1.87 as the exchange’s held supply fell to its lowest level since 2018, reinforcing the float-tightening narrative even as the price remains stuck below the heavy $1.88-$2.00 resistance band that has repeatedly capped rebounds.

News context

Foreign exchange balances are again treated as a key signal. The supply held on trading platforms has fallen to around 1.6 billion XRP, down around 57% since October, suggesting that more tokens are being stored or held for the longer term rather than ready to be sold.

The pullback comes during a broader phase of selective positioning among the majors: institutions are increasingly relying on structured and regulated rails for exposure while spot markets remain volatile, leaving tokens like XRP trading with a supply of long-term support but fragile short-term momentum.

For XRP in particular, falling exchange stocks are important because they can amplify moves when demand picks up – but it doesn’t guarantee an upside if sellers come in at known technical levels (and $2 has been that level).

Technical analysis

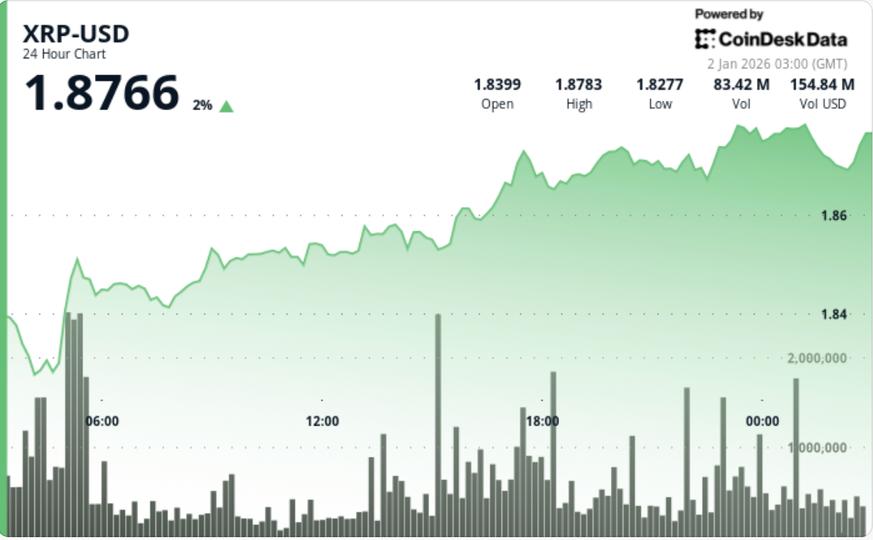

XRP climbed approximately 1.7% from $1.84 to $1.87, posting higher lows throughout the session and maintaining a relatively contained range of $0.05 (approximately 2.5% intraday volatility). Participation improved at the right time: volume increased during the upward surge (around 32 million, or around 50% above average) – a sign that this was not simply an upward drift on low liquidity.

But the tape still reads like a controlled recovery inside a wider cap. XRP has slowed several times as it approaches the $1.88 area, a level that also corresponds to a broader resistance zone ahead of the $2.00 psychological handle. This is important because recent attempts to reclaim $2 have quickly failed, turning the region into a supply zone where sellers are comfortable relying on rallies.

Momentum indicators are mixed. Some oscillators are showing bullish divergence (momentum is improving even if price has not completely broken out), but the market still needs follow-through above resistance to validate it. On the lower side, the structure looks constructive as long as XRP holds above the $1.82-$1.83 base of the session’s early tests – and more broadly above the $1.77 floor that was the next clear pocket of demand.

Price Action Summary

- XRP rallied from $1.84 to $1.87, posting a consistent series of higher lows

- Volume increased during the rally, peaking at around 32 million, about 50% above average.

- The price stalled near the $1.88 resistance, keeping the wider $1.77 to $2.00 range intact.

- Late session action consolidated around $1.873, signaling an inflection point rather than a breakout.

What Traders Need to Know

The story is one of a tug of war between the tightening of available supply and a well-defined ceiling of resistance.

The key levels are clean:

- Bull case: A sustained push above $1.88 opens the door for a run towards $1.95, with $2.00 as the breakout trigger. A net recovery of $2 would likely attract buyer momentum and force the repositioning of sellers who have been defending this area.

- Bear Case: Failure to maintain the $1.82 base at $1.83 shifts focus back to $1.77, the next significant pocket of demand. If this happens, the risk extends to the downside to the next broader support region (where buyers historically re-emerge), but the near-term battleground is clearly $1.77 vs. $1.88.

For now, the diminishing FX supply keeps the long-term setup constructive – but the market still needs a decisive win above $1.88 to $2.00 before the bullish narrative can take control of the band.