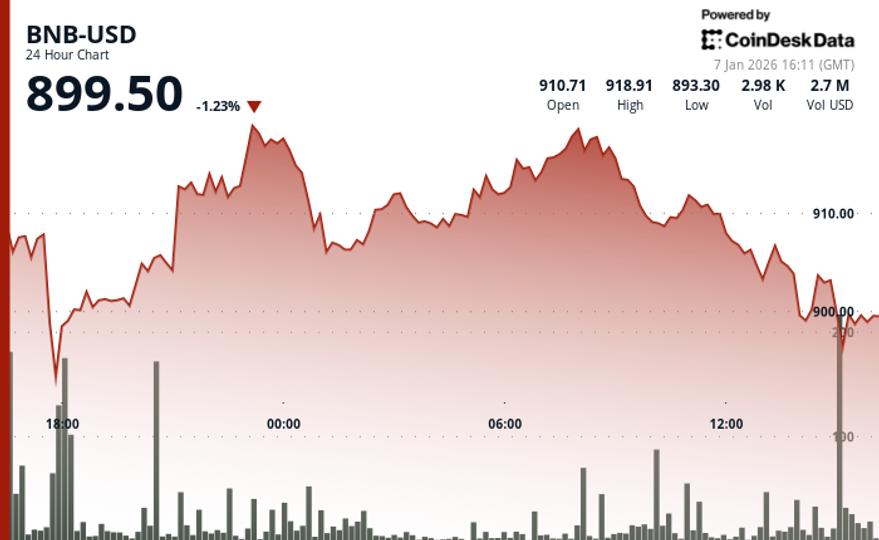

BNB fell below $900 after a day of consistent losses and heavy selling across the entire cryptocurrency market, despite several technical upgrades and ecosystem developments across the BNB chain.

The token fell 2.2% with sellers taking control as rebound attempts stalled below key resistance zones, according to CoinDesk Research’s technical analysis data model. The broader market, as measured by the CoinDesk 20 Index (CD20), fell 2.6%.

Volume surged during the day to well above average levels, signaling increased liquidity. The price action has formed a descending channel, with each rebound weaker than the last. A strong breakout late in the session confirmed the bearish momentum and moved the $900 level from support to resistance.

This drop came even as BNB Chain’s Layer 2 network, opBNB, completed a major upgrade. The Fourier hard fork cut block times in half, doubling transaction throughput. The change was designed to improve the performance of applications built within the network’s decentralized finance (DeFi) ecosystem.

Elsewhere in the BNB ecosystem, Binance introduced perpetual silver futures, its first foray into commodities, and launched a $1 million staking campaign with high-yield offerings on major tokens. BNB can be used to receive discounts on trading fees on exchanges.

Yet traders have focused on technicals rather than fundamentals. Broader altcoin weakness, linked to bitcoin’s recent pullback and overall market caution, weighed on sentiment.

For BNB to return to a bullish position, it would need to find resistance levels near $906 and break out of its current downtrend. Until then, the pressure could persist, with downside targets near $892 or even lower.

Disclaimer: Portions of this article were generated with the help of AI tools and reviewed by our editorial team for accuracy and compliance with our standards. For more information, see CoinDesk’s full AI policy.