Prediction market platforms Polymarket and Kalshi spend a lot of time and money convincing regulators otherwise. gambling.

Outside the United States, authorities consider prediction markets synonymous with gambling. Taiwan, France and now Singapore have all taken steps to block users from accessing Polymarket at the ISP level, calling the prediction market platform a sort of unlicensed gambling operation.

Prediction markets are investment tools in which traders take a position on the outcome of an issue.

Parties and counterparties have divergent opinions on how to price competing aspects of the matter, and the market engages in price determination. If the event occurs, each share will be worth $1, or $0 if the event does not materialize.

It’s not a game of chance. Prediction markets are not considered games of chance (in the United States) because they are designed as tools for predicting outcomes based on probabilities rather than games of chance. The house does not set the odds or win. It all depends on the market players.

In the United States, the Commodities Futures Trading Commission sees its role as regulating forecast markets, because it views markets as a set of event-driven contracts, similar to weather derivatives – not a new invention – used by farmers to protect yourself against crop losses by purchasing contracts. who pay in case of bad weather. Climate change has made this a lucrative field.

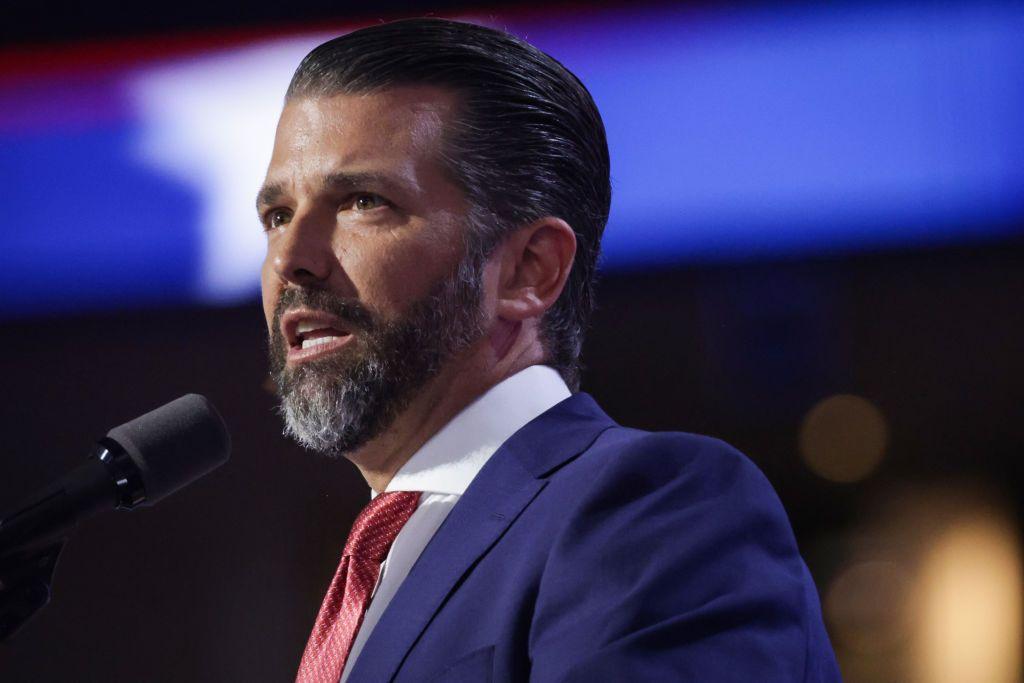

Polymarket and Kalshi have had their own fights with the CFTC. Polymarket settled, Kalshi won. As a result, Kalshi is now authorized to offer election-based event contracts; Polymarket must prevent American users from accessing its platform. Kalshi also now has Donald Trump Jnr. as an advisor, helping his case with regulators.

Election event contracts were big business in the 2024 elections. Looking at how the market reacted to Donald Trump’s eventual victory, we can view them as financial instruments intended to prepare for a post-election market.

Given Bitcoin’s “Trump Bump”, a significant price correction could be expected if rival Kamala Harris wins, so crypto traders would want to hedge their holdings with predictive market positions.

Polymarket’s opponents wrongly bet on the platform’s disappearance after the elections. The data showed that, clearly, the platform was doing very well after the election: $1.6 billion in monthly volume.

Shayne Coplan: he generalized prediction markets

But much of that volume comes from sports-themed prediction market contracts. Data from Polymarket Analytics shows that there is currently over $1.1 billion in betting volume on the outcome of the NFL Super Bowl; 740 million dollars from the result of the Champions League; and $700 million for the winner of the NBA Finals.

There is no macro-level importance to the outcome of a sporting event. Unlike an election, a war, or a decision by a Fortune 500 company to acquire a rival (or add bitcoin to its balance sheet), there are no broader financial or societal consequences to the from the NFL Super Bowl.

In other words, it’s a lot like online sports betting, which required a herculean effort to get legalized and has its own set of strict licensing requirements. Online gaming operators have spent considerable sums to establish – and legalize – this market, with traditional casinos like MGM catching up.

In jurisdictions like Singapore that have licensed online sportsbooks that offer sports betting, it is obvious that a ban needs to be imposed. In the United States, state-level gambling regulators could be next to take an interest, perhaps led by online sports gaming giants who have legalized a once-banned industry.

This is not to say that there is no place for sports-themed prediction market contracts.

The NFL’s broadcast rights are worth more than $100 billion and streamers like Amazon and Netflix are trying to get into the sport, making market contracts predicting viewership for the NFL, for example, a tool useful for shareholders of media companies to determine whether an investment in broadcast rights is worth it.

The possibilities are endless.

Or maybe Polymarket should just move to Canada because Ontario allows political and sports betting. Sometimes the smartest bet is a change of scenery, and there’s no prediction market for that.