As US weekend storm disrupted bitcoin As higher costs affect profitability and lead companies to reduce computing power, or hashrate, crypto traders will focus on a metric known as the Hash Ribbon, an indicator built on the principle that the price of the largest cryptocurrency often hits a low during periods of so-called miner capitulation.

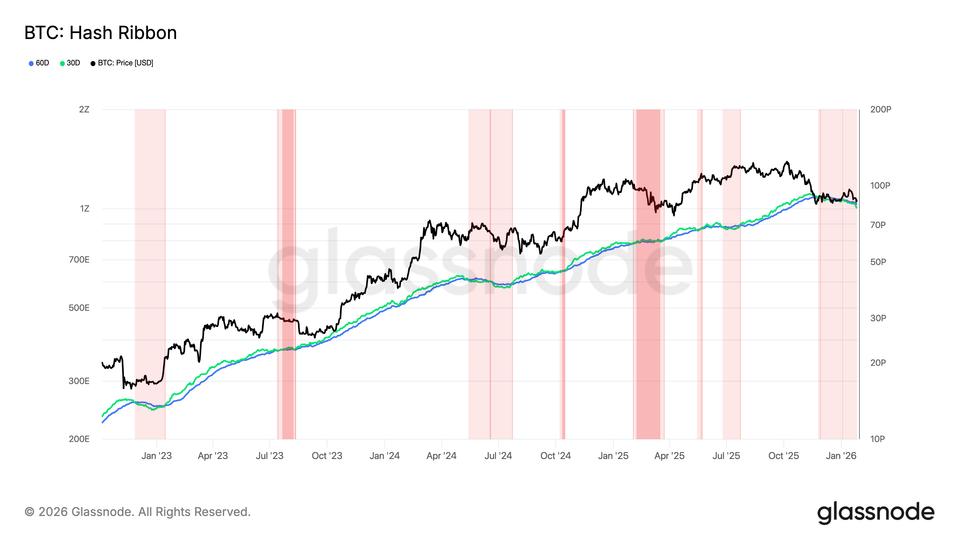

In the past, periods where miners were forced to slow down or shut down their machines preceded stronger phases for Bitcoin once conditions stabilized. This is reflected in the Hash Ribbon, an indicator that tracks the 30- and 60-day moving hashrate averages, on Glassnode.

Capitulation is signaled when the short-term average falls below the long-term average, shown in light red. The worst phase is considered over once the 30 day measurement returns above 60 days, represented by a darker red. Historically, when this rally aligns with a change in price dynamics from negative to positive, marked by a transition from dark red to white, it has coincided with long-term buying opportunities.

The measured hashrate, the total computing power securing the Bitcoin blockchain, fell by about 20%, from about 1.2 zettahashes per second (ZH/s) to about 950 exahashes per second (EH/s). This means that the next difficulty adjustment, which is used to maintain consistent 10-minute block times, is expected to decrease by approximately 17%. This would be the largest drop in difficulty since July 2021, when China banned bitcoin mining.

Hash Ribbon last capitulated in late November, when bitcoin hit a low around $80,000. It’s now about $88,000.

A comparable trend emerged in mid-2024. Following a capitulation of the Hash Ribbon and the unwinding of the yen carry trade, bitcoin bottomed near $49,000 in August before rallying to $100,000 the following January.

During the collapse of crypto exchange FTX in 2022, bitcoin hit a low of nearly $15,000 amid miner capitulation. Once Hash Ribbon normalized, the price rebounded to around $22,000.

The key question now is whether the pattern repeats itself and bitcoin enters a new phase of expansion when the hashrate and Hash Ribbon begin to normalize.